Pay 1% Now. Plan for 0%. Georgia’s Startup Tax Future Explained

- Tinatin Tolordava

- Jul 7, 2025

- 10 min read

Table of contents

Georgia’s Tax Game: 1% for Freelancers, 0% for Future Innovators

Georgia has earned its reputation as one of the most tax-friendly countries for freelancers, entrepreneurs, and tech founders. But understanding exactly how its most popular tax regimes work, and when to use them, is where most people get stuck.

On one side, you have the 1% tax regime for Individual Entrepreneurs with Small Business Status. It’s easy, predictable, and optimized for solo earners.

On the other, there's the upcoming 0% corporate profit tax regime for LLCs that qualify for Innovation Status. While the law is still pending, the expected savings could be enormous for startups with the right model.

The 1% Tax Regime in Georgia: How It Works and Who It’s For

Looking for a tax setup that doesn't drain your time or money?

Georgia's 1% tax regime is as close to a freelancer's paradise as it gets. If you're a solo business owner billing clients internationally, this structure was practically built for you.

It keeps things simple, keeps your costs low, and keeps your time focused on running your business, not chasing paperwork.

Officially, it’s called the "Small Business Status for Individual Entrepreneurs," but what it really means is this: pay just 1% of your revenue in taxes, up to a cap of 500,000 GEL a year.

No profit calculations. No corporate hoops. If you make 200,000 GEL, you owe exactly 2,000 GEL in tax. Just straightforward, predictable numbers that let you breathe.

What Makes the 1% Tax Regime So Unique

This isn’t a tax break based on expenses or profit margins. It’s a regime designed to simplify taxes for people who work alone.

You don’t need to hire an accountant. You don’t need to collect receipts or track VAT unless you hit the threshold. You simply declare your monthly turnover, pay 1%, and move on with your business.

You also don’t need a local partner or investor. You can register as a foreigner. You can operate entirely in foreign markets. And as long as your services are exported, you won’t trigger local VAT or income tax on that income.

This makes Georgia’s small business tax regime especially attractive for:

Freelancers offering software development, design, content writing, or marketing services

Business consultants billing international clients

Coaches, educators, and service providers with remote delivery models

Digital nomads earning in USD or EUR but based in Tbilisi or Batumi

Remote workers moonlighting as entrepreneurs or agency owners

All of these use cases fall under the 1% regime, provided they register as Individual Entrepreneurs and apply for Small Business Status.

How to Qualify and Apply for the 1% Tax Regime in Georgia

Step one: Register yourself as an Individual Entrepreneur (I.E.) through the Public Registry. This takes one day and requires your passport and a Georgian phone number. If you’re outside the country, you can do this via power of attorney.

Step two: Once you have your I.E. registration, log in to the Revenue Service (RS) portal and apply for Small Business Status. This is a separate approval. If accepted, your income will be taxed at 1%, starting that month.

The rules are clear:

You must not exceed 500,000 GEL (about $185,000) in revenue during the calendar year

You cannot hire full-time employees

You must declare your income monthly

You must issue official invoices (in Georgian) for each service sold

Once you’re approved, you’ll receive a tax certificate showing your status. This is often requested by clients, banks, or accountants, especially if you plan to open a business bank account in Georgia.

What You Gain, and What You Don’t

What’s included under the 1% regime:

1% flat tax on turnover (not profit)

No dividend tax

No corporate profit tax

No mandatory social contributions

No VAT unless your revenue crosses 100,000 GEL in the previous 12 months

No tax on foreign passive income (like dividends or interest from abroad)

What’s not included:

No employee payroll or team scaling

No legal separation between you and the business

No capital structure or shares

No equity investors or grant eligibility

No limited liability

This is a personal business. That means your name is legally tied to it. If you sign a client contract, it’s under your personal liability. If you get sued, it’s on you. That’s the trade-off for simplicity and low tax.

Still, for many freelancers and early-stage solopreneurs, this setup offers everything they need and nothing they don’t.

The 0% Corporate Tax Model Through Innovation Status

Now let’s switch gears.

If you’re building something scalable, investing in intellectual property, or forming a real startup team, the 1% regime won’t be enough.

That’s where Georgia’s upcoming Innovation Status comes in.

On March 31, 2025, the Georgian government confirmed what many in the tech and business community have been waiting for: innovative startups in Georgia will be eligible for up to 10 years of tax breaks, including 0% corporate income tax for the first 3 years.a

It’s a planned tax incentive created for tech companies and product-focused businesses. As of now, the legal framework is still being finalized.

Instead of paying 15% corporate tax, eligible companies will receive 0% corporate profit tax for profits that remain in the business. Even dividends paid to foreign owners will often be tax-exempt.

This regime will provide your Georgian LLC the ability to grow without tax drag, perfect for reinvesting in development, marketing, or hiring.

Eligibility Criterias for Innovative Status

Eligibility criteria will be finalized once amendments to the Law “On Innovations” and the Tax Code are fully implemented.

However, there are already some foundational criteria in place. To be eligible for Innovation Status, your company must:

Be registered as an LLC in Georgia

Operate in qualified innovation sectors such as software development, AI, robotics, biotech, or R&D

Be conducting product development inside Georgia or via local talent

Have intellectual property that is either registered in Georgia or developed by a Georgian entity

The government wants real innovation happening inside Georgia. That’s why shell companies or passive IP holding structures won’t qualify. They want to see active work being done by your team, freelancers, or partners within the country.

If approved, your LLC will be designated as an “Innovation Entity” and is going to gain access to several tax breaks.

Which Tax Benefits will Innovative Status Bring?

The newly announced incentive package by the Georgian government will bring these tax benefits as soon as it becomes active:

Zero corporate tax: You can reinvest every lari of your profit back into your business without losing 15% to the state.

Zero dividend tax for foreign owners: Planning to distribute profits? Non-resident shareholders don’t pay a cent on dividends in Georgia.

Only 5% tax on salaries: Hiring local staff? Your wage bill gets lighter thanks to the reduced personal income tax.

Lower pension and social contributions: The extras you owe on top of salaries are cut down too.

No withholding tax on payments to foreign contractors: Work with global talent without triggering double taxation.

Eligible for grants and innovation programs: With the right setup, your company could tap into government-backed funding or support.

These benefits make Georgia a compelling base for serious startups who need room to grow without getting squeezed by early-stage taxes.

Once active, Innovative Status will become one of the strongest tech startup tax packages anywhere in the region. But keep in mind: this regime is not yet in action. Businesses will need to monitor the legal rollout closely to know exactly when and how to apply.

What’s the Catch?

While the 1% regime is hands-off, Innovation Status will probably come with more responsibilities:

You might need a qualified accountant to maintain financial records

You’ll file quarterly reports and an annual activity review

You might need to hire or partner with people inside Georgia

You will need to show progress on your product or R&D work

Your IP should be linked to the Georgian entity, not just licensed from abroad

In return, you will receive a tax shield that can help you reinvest every cent into building something valuable, while maintaining clean legal standing with tax authorities in Georgia and abroad.

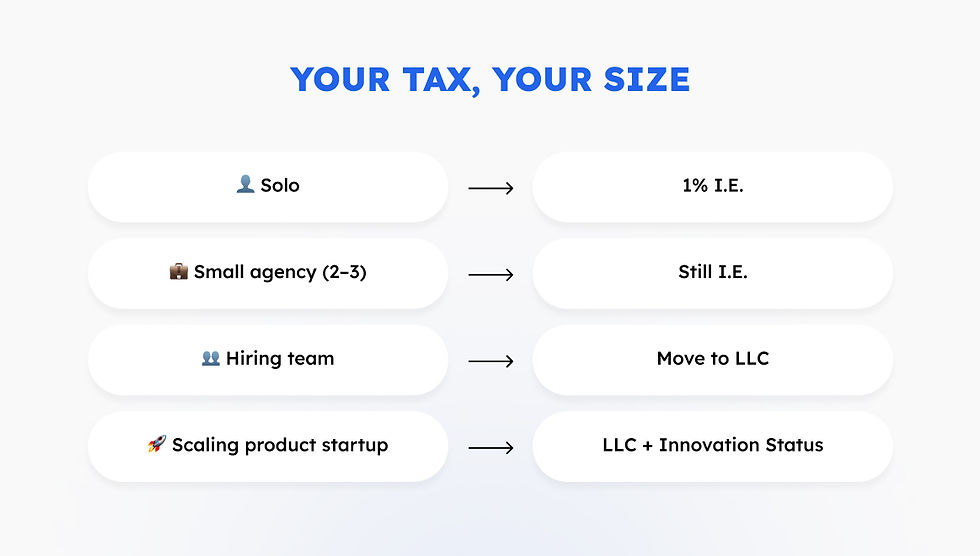

A Quick Recap: How to Decide

Choose the 1% I.E. regime if:

You’re a solo operator with no team

You invoice for services, not products

Your income is under 500,000 GEL per year

You want the lowest tax with the least paperwork

Aim for the 0% Innovation Status if:

You have or plan to build a tech product

You operate as a team or plan to hire

You need legal separation and limited liability

You want to reinvest revenue instead of paying yourself

1% or 0%: What’s the actual difference?

Here’s a practical breakdown.

Factor | 1% Tax (I.E.) | 0% Corporate Tax (LLC with Innovation Status) |

Legal Form | Individual Entrepreneur | Limited Liability Company |

Tax Type | 1% on revenue | 0% on reinvested profit |

Dividend Tax | Not applicable | 0% for non-residents |

Employees | Not allowed | Required or strongly recommended |

Admin | Minimal | Requires accounting and reporting |

Legal liability | Personal | Corporate protection |

Ideal for | Freelancers, consultants, solo nomads | Startups, SaaS, tech founders, R&D teams |

Choosing the right regime isn't about which number is smaller. It’s about what your business needs right now and where it’s going.

If you're billing $100K alone and keeping costs low, 1% is unbeatable. If you're building something with scale in mind, the 0% model will give you room to grow without paying out half your cash in taxes. So, keep up with the updates: the law might become active anytime soon.

When should you switch from 1% to 0%?

A lot of founders in Georgia start as Individual Entrepreneurs to test the waters. That’s smart. It’s fast, cheap, and comes with almost no obligations.

But things change. You get clients. You grow. You hire. Suddenly, the 1% tax regime starts to feel like a limitation instead of a benefit. Once the new law about Innovative Status takes effect, you’ll be able to scale your business while still enjoying minimal tax rates.

However, even before the 0% tax regime becomes active, you can switch from I.E. to LLC and position yourself early. Here are the signs it might be time to switch:

You’re making more than 500,000 GEL annually

You want to hire full-time staff under your entity

You’re applying for grants or innovation funding

You want to limit liability and operate like a real company

You’re building IP and reinvesting profits instead of distributing them

Transitioning from I.E. to LLC is common in Georgia. Gegidze helps with the restructuring, including legal closure of your I.E., registration of your new company, and reapplication for tax status under the LLC model.

Need the full picture? Read:How the 1% Tax Regime WorksandWhat is Innovation Status in Georgia

Banking and compliance: don’t skip this part

The tax regime is just one piece of the puzzle. Once you’re registered, you’ll also deal with Georgian banks, the Revenue Service, and monthly declarations.

If you’re operating under the 1% regime, the paperwork is light, but not optional. You’ll still need to:

File monthly turnover

Provide invoices upon request

Use a business account instead of your personal one

If you're running an LLC and preparing to obtain Innovation Status, expect full corporate-level compliance.

You’ll need:

A dedicated accountant

Monthly financial statements

Payroll reporting if you have staff

Proper documentation for every large transaction

This is where many founders fall behind and get flagged. The good news? You can avoid this by using the right structure from day one.

For banking structure tips, read:Banking Compliance in Georgia

What real founders do

We’ve seen every setup you can imagine.

Some freelancers operate entirely under the 1% tax system for years. They invoice foreign clients, declare once a month, and live tax-free otherwise.

Others use the I.E. model to start, then switch to LLC as they build a team or prepare for funding.

We’ve even helped hybrid models, an I.E. for consulting income and a separate LLC for a tech product.

Bottom line: there is no one-size-fits-all. But there is a setup that fits your current situation better than the rest.

Final verdict: which tax regime is right for you?

If you’re working solo, under the income threshold, and want the lowest possible tax rate with minimal obligations, the 1% regime is unmatched.

If you’re scaling, building IP, or planning to raise investment, Georgia’s upcoming 0% corporate tax model is expected to offer the tools and flexibility of a full company, without the tax burden you’d face in Europe or the US.

It’s not active yet, but positioning yourself now can put you ahead once the law takes effect.

Gegidze helps founders make the right choice of choosing the best business structure every day. We’ll set up your legal structure, guide you through the tax system, and handle compliance long-term. No guesswork. No surprises.

Book your free consultation today and we’ll help you choose, register, and grow, tax smart from day one.

Frequently asked questions (FAQ)

Who qualifies for the 1% tax regime in Georgia?

Any individual working as a solo service provider can apply for the 1% tax regime by registering as an Individual Entrepreneur and obtaining Small Business Status. This setup is ideal for freelancers, consultants, and digital nomads earning under 500,000 GEL annually.

What is Georgia’s upcoming 0% corporate tax regime for startups?

Georgia is introducing a 0% corporate profit tax for LLCs that qualify for Innovation Status, aimed at startups building intellectual property locally. Once the law takes effect, eligible companies will be able to reinvest profits without paying corporate tax. It’s not active yet, but founders can prepare in advance to qualify.

Can I switch from the 1% regime to the 0% tax model later?

Yes. Many founders begin under the 1% regime for its simplicity, then switch to an LLC structure once they start scaling. While the 0% corporate tax model isn’t active yet, you can still prepare now. Gegidze helps with the full transition, including legal restructuring and future eligibility for Innovation Status.

What are the promised tax benefits under Innovation Status in Georgia?

Companies with Innovation Status will pay 0% corporate profit tax, 0% dividend tax for foreign shareholders, and only 5% on salaries.

What happens if I exceed 500,000 GEL under the 1% tax regime?

Once your revenue crosses the threshold, your tax rate increases to 3%, and you risk losing Small Business Status. That’s often a sign it’s time to consider switching to a corporate structure with Innovation Status.