7 Days Business Setup in Georgia: How to Get TIN

- Tinatin Tolordava

- Sep 4, 2025

- 6 min read

Table of contents

Day 3 - Secure Your TIN

Day 1 was exciting. You learned the golden rule of Georgia: pay just 1% tax instead of the painful 30 to 40 percent you would lose elsewhere.

Day 2 was the fork in the road.

You picked your structure.

You either became an Individual Entrepreneur Georgia under the SBS Georgia small business program, you decided to register an LLC in Georgia, or you looked at the Georgia Virtual Zone for 0% corporate tax on foreign IT income.

Now it is Day 3.

This step may feel small but it is the most practical step of them all.

Without it, you cannot open a bank account, you cannot issue invoices, and you cannot file for the Georgia small business status 1% tax up to 500,000 GEL official Revenue Service program.

The step is getting your Georgia Taxpayer Identification Number. In short, your TIN.

Why the Georgia TIN Is Your Business Passport

Think of the TIN as your official ID in the world of Georgian taxes.

Whether you are a freelancer registering as Individual Entrepreneur Georgia, a founder who wants to register an LLC in Georgia, or a tech company looking for Georgia Virtual Zone status, the Georgia tax ID number is mandatory.

No TIN means no legal invoices, no way to prove your company to clients, and no chance to benefit from the Georgia 1% tax regime.

Every system you want to use in Georgia starts with the TIN.

How the TIN Connects to Your Tax Path

Your Georgia taxpayer identification number is more than just a number. It decides how you are linked to the Georgia Revenue Service.

If you are an Individual Entrepreneur Georgia, your TIN is tied to the SBS Georgia 1% tax system. That means you can pay only 1% on your turnover up to 500,000 GEL.

If you register an LLC in Georgia, your TIN connects you to the Georgia country corporate tax rate of 15% on distributed profits, with 5% dividend tax on payouts.

If you operate in IT or blockchain and qualify for the Georgia Virtual Zone, your TIN becomes your entry to 0% corporate tax on foreign-sourced IT revenue.

It is the same small number but it unlocks very different tax outcomes.

How to Get a Georgia Tax ID Number Step by Step

The process is simple when done correctly.

Register your business with the National Agency of Public Registry. Whether you choose IE or LLC, this step comes first.

In many cases, your Georgia business tax ID is issued automatically by the Georgia Revenue Service within 1 to 2 business days.

If it is not automatic, you apply directly through the Revenue Service portal at rs.ge or in person at one of their offices.

You prepare the required documents. For most cases this includes:

A copy of your passport

Registration certificate if you are an LLC

Company identification number for LLCs

Power of attorney if you authorize a representative to file for you

Once accepted, you receive your Georgia TIN and you can now operate fully in the tax system.

The cost is zero. The process is fast. But if you make a mistake with paperwork or translations, delays happen.

Do You Need to Be in Georgia to Get Your TIN

The answer is no.

Foreigners can get a Georgia tax ID number without being physically present in Tbilisi or Batumi. You can authorize a representative with a power of attorney.

This makes it possible to register business in Georgia remotely.

There is a catch.

While the Georgia Revenue Service can issue your TIN remotely, most banks want you to appear in person.

That is why Day 4 of this series is dedicated to banking. You will see exactly how to pick the best bank in Georgia for foreigners and how to avoid being blocked by compliance departments.

Why Getting Your TIN Early Matters

The TIN seems small but it has a big impact.

Imagine you start invoicing clients without your TIN. Later the Georgia Revenue Service reviews that income and taxes it at the 20% Georgia country tax rate. You miss your chance to qualify for the Georgia 1% tax regime from the start.

This mistake is common. It is also expensive. One late registration can wipe out the very savings that brought you to Georgia in the first place.

If you want to benefit from SBS Georgia small business status 1% tax turnover 500,000 GEL official Revenue Service, the TIN is the first piece of paperwork you should care about.

Common Mistakes with TIN Applications

Entrepreneurs who fail at this step usually make one of these mistakes:

They assume the TIN will be issued automatically. It often is, but not always. Double-check with the Georgia Revenue Service.

They forget to provide proper Georgian translation services for their documents, which causes rejection or delay.

They wait to apply until they already have revenue, losing their right to the georgia 1% tax on that income.

They forget to register for VAT once they cross the threshold, which means no Georgia VAT refund later when they need it.

Every mistake on this list is avoidable with the right planning.

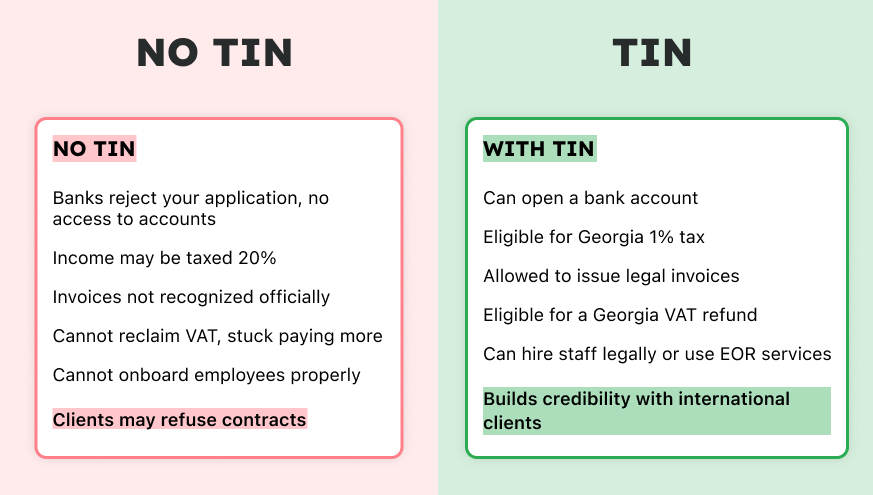

TIN vs No TIN in Georgia

With a Georgia Tax ID Number (TIN) | Without a Georgia Tax ID Number (TIN) |

Can open a bank account with the best bank in Georgia for foreigners | Banks will reject your application |

Eligible for Georgia 1% tax under SBS Georgia | Income defaults to the 20% Georgia country tax rate |

Allowed to issue legal invoices under Georgian law | Invoices are not recognized officially |

Can file monthly declarations with the Georgia Revenue Service | Cannot file or report taxes |

Eligible for a Georgia VAT refund if VAT registered | No access to reclaim VAT |

Can hire legally or use Georgia EOR | Cannot onboard employees properly |

Builds trust with global clients | Clients may refuse contracts without official tax ID |

What Happens After You Get Your Georgia TIN

This is the point where your setup in Georgia stops being theory and becomes real. With your Georgia taxpayer identification number active, you can:

Open your bank account and choose the best bank in Georgia for foreigners with multi-currency access and international support.

File monthly Georgia 1% tax declarations through the Revenue Service.

Apply for VAT if needed and claim a Georgia VAT refund.

Hire employees properly or test with Georgia EOR if you are not ready for full payroll.

Send invoices that clients will actually accept under Georgian law.

It is the difference between being a registered entrepreneur and just saying you are.

Day 3 Action Step

Your mission today is clear. Get your Georgia business tax ID immediately after registering your company.

Do not wait until you invoice. Do not assume it is automatic. Make sure your TIN is issued, recorded, and working before you take your first client payment.

This number is the oxygen of your Georgian setup. Without it, everything else in the system stays red. With it, the green lights switch on.

What’s Next: Day 4 — Open a Bank Account in Georgia

Now you have your structure and your TIN. But your money is still floating in theory until you land it in a Georgian bank.

Day 4 is where we cover banking.

Which bank is the right one?

How to prepare documents?

Why can the wrong bank block your payments for weeks?

And how to secure the best bank in Georgia for foreigners based on your specific business model?

Tomorrow, we unlock your access to banking in Georgia.

Do not wait until problems hit. Contact Gegidze today.

We secure your registration, obtain your Georgia taxpayer identification number fast, and ensure you qualify for the Georgia 1% tax regime from day one.

Let’s make your business official the right way.