7 Days Business Setup in Georgia: IE vs LLC vs Virtual Zone

- Tinatin Tolordava

- Sep 4

- 8 min read

Table of contents

Day 2 - Choose IE, LLC, or Virtual Zone

Yesterday you learned the golden rule of Georgia. Pay just 1% tax instead of handing half your income to the government. Simple. Official. Legal.

Today you face your first real fork in the road.

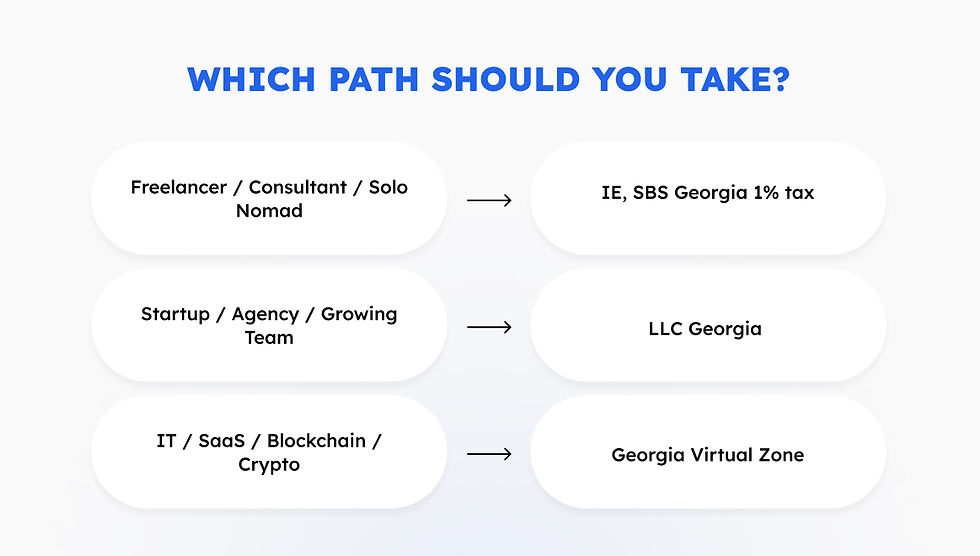

Do you go lean and register as an Individual Entrepreneur in Georgia? Do you build bigger and register LLC in Georgia? Or do you claim the tech badge with the Georgia Virtual Zone?

This choice is not just paperwork. It sets your tax rate. It shapes your risk. It affects how clients see you. Choose well and Georgia works beautifully. Choose poorly and you will overpay or lose benefits from SBS Georgia.

Think of Day 2 as choosing your game mode. Solo. Squad. Or Tech VIP.

The Lean Choice: Individual Entrepreneur Georgia with SBS 1% Tax

If you are freelancing, consulting, or doing online jobs in Georgia for foreign clients, this is the clean path. The SBS Georgia program is the famous Georgia 1% tax regime.

What you get

Georgia small business status 1% tax up to 500,000 GEL official Revenue Service. Your turnover up to the cap pays 1% tax.

Fast setup. You can open a company in Georgia as an IE in about two business days.

A structure that works for the Georgia digital nomad visa lifestyle. You earn globally and keep admin light.

What this means in real money

A designer earning 100,000 USD in Europe may pay 35,000 USD or more in tax. The same designer as an Individual Entrepreneur Georgia under SBS Georgia pays about 1,000 USD. That is the power of Georgia 1% tax.

Where IE shines

Solo consultant serving clients abroad.

Content creator billing platforms outside Georgia.

Developer with a remote client base.

Anyone who wants speed and certainty from Day 1.

Limits to respect

You are personally liable. There is no limited liability shield.

Some industries are excluded. Finance, gambling, and large-scale trading do not qualify under SBS Georgia.

Cross the 500,000 GEL turnover cap and you move to 3% or lose the regime for the next period.

Banking and basics for IE

You still need a bank that understands you. Pick the best bank in Georgia for foreigners that supports multi-currency, clean online banking, and fast compliance checks. If you invoice in USD or EUR, choose a bank that handles those flows daily. This alone can save you weeks.

You will also need a TIN, monthly declarations, and clean records. The rules are simple. Follow them and the Georgia 1% tax stays yours.

The Solid Choice: LLC Georgia

LLC is the move when you want to scale. When you want to hire. When you want your brand to look serious the moment a client checks your company profile.

Why founders choose an LLC in Georgia

Limited liability. Your personal assets stay separate from business risk.

The Georgia corporate tax rate is 15% and only on distributed profits. If you reinvest, no corporate tax is due on that amount.

Dividends are taxed at 5%.

Clients and partners often prefer contracting with a company rather than a person.

Where LLC shines

A web development company in Georgia with a growing team.

A boutique agency selling to EU or US enterprises.

Founders preparing for investment and larger contracts.

Companies that plan to hire through payroll or via Georgia EOR in the short term.

Compliance you should expect

You will keep proper books. You will produce reports. Documents may need Georgian translation services for the registry or banks. This is normal. If you already operate in Europe or North America, the workload will feel light by comparison.

VAT and refunds

Many exports of services remain out of scope for VAT. Some purchases still trigger reverse VAT rules.

Plan ahead and you can handle a Georgia VAT refund or input credit without frustration. The key is to structure invoices and vendor payments correctly from day one.

Tax picture for LLC

Georgia country corporate tax rate at 15% on distributed profits.

5% on dividends when paid.

No corporate tax on profits that remain reinvested.

Personal income tax for employees at 20% if you run payroll.

If you want credibility plus room to grow, register LLC in Georgia. It costs a little more in time and attention. It pays back in trust and protection.

The Power Choice: Georgia Virtual Zone

This is the tech VIP pass. It is tailored for software, SaaS, and blockchain. If you write code, ship software, or sell digital services abroad, the Georgia Virtual Zone can be a game changer.

Why founders love the Virtual Zone

0% corporate income tax on foreign-sourced IT revenue.

No VAT on exported digital services, so no chasing a Georgia VAT refund for those sales.

You can run globally. A physical office is not required for the tax benefit.

Pairs neatly with Georgia crypto tax planning for Web3 companies.

Who qualifies

Software development and product companies.

SaaS platforms billing clients outside Georgia.

Cybersecurity, DevOps, AI, or data engineering teams.

Blockchain and crypto infrastructure builders.

What trips people up

Applications get rejected for vague activity descriptions or poor documentation. This status is for IT. Not marketing. Not general consulting. If your product is software, say it clearly and show it clearly.

A simple picture

A SaaS startup billing 500,000 USD abroad may see 25% corporate tax in London. In Georgia, with Virtual Zone status, that corporate tax can be 0%. Dividends still face 5% when distributed. Payroll remains payroll. The core profit stream stays extremely efficient.

Set up well. Operate cleanly. Keep the benefit. That is the Virtual Zone promise when you qualify.

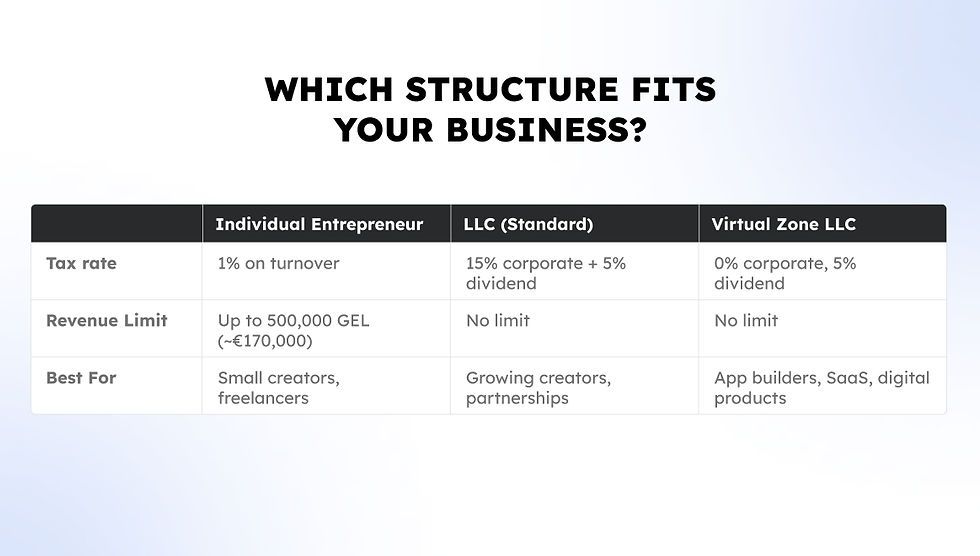

IE vs LLC vs Virtual Zone — The Quick Comparison

Use this to scan your options fast.

Structure in Georgia | Tax headline | Best for | Strengths | Trade-offs |

Individual Entrepreneur Georgia with SBS Georgia | Georgia 1% tax on turnover up to 500,000 GEL | Freelancers, solo consultants, digital nomads | Fast, cheap, simple. Perfect with georgia digital nomad visa | Personal liability. Excluded activities. Turnover cap applies |

LLC Georgia | 15% corporate on distributed profits. 5% dividend | Startups, agencies, teams, partnerships | Liability shield. Credibility. Reinvestment defers corporate tax | More paperwork. Accounting and possible Georgian translation services |

Georgia Virtual Zone | 0% corporate on foreign IT income | IT, SaaS, AI, blockchain, crypto | Huge savings. VAT-light exports. Remote-friendly | Strict scope. Strong application needed |

Three short stories to make the choice real

Marta, content strategist, solo.

Marta invoices clients in the US and EU. She lives in Tbilisi on the Georgia digital nomad visa.

As Individual Entrepreneur Georgia under SBS Georgia, she pays 1% on 120,000 GEL.

She keeps her books simple. She picks the best bank in Georgia for foreigners for a clean USD account and easy SWIFT.

Her tax life is now boring. That is the goal.

Levan and Ana, agency founders.

They run a five-person design and dev shop.

They register LLC in Georgia for liability and client trust. They reinvest in staff and tooling, so corporate tax on reinvested profits is not due.

When they distribute profits, they accept 15% corporate on that part and 5% dividend.

Easy win.

Sara, SaaS builder.

Sara sells a data tool by subscription.

Her customers are in North America and Western Europe.

She applies for the Georgia Virtual Zone with a crisp scope. Approval lands. Her corporate tax on foreign IT income is 0%.

She hires two contractors through Georgia or while the team grows. Cash goes to the product, not to the government.

If you see yourself in one of these, your decision is already close.

The extras that matter regardless of structure

Banking

Your bank is your daily partner. Choose the best bank in Georgia for foreigners for your case. If you run subscriptions, you want predictable incoming wires and clean reconciliation. If you deal with marketplaces, you want strong compliance support. Switching banks later is painful. Start right.

VAT

IE under SBS Georgia usually avoids VAT for exports. LLC and Virtual Zone companies may still touch reverse VAT on some services they buy. Set up the process early and a Georgia vat refund becomes a routine line in your finance calendar instead of a surprise.

Residency and the 183-day point

If you pass 183 days in Georgia you can become a tax resident. Plan this with your accountant so Georgia country tax rate rules work for you, not against you. The goal is always simple. Pay the right amount. Never pay twice.

Crypto and Web3

If your revenues or treasury touch tokens, map it carefully. Many teams structure products under Georgia Virtual Zone and handle treasury with clear policies. Good planning makes Georgia crypto tax questions boring. Again, that is the point.

How to decide without guesswork

Use three questions and be honest with yourself.

Are you working solo and staying under the 500,000 GEL cap? If yes, Individual Entrepreneur Georgia with Georgia 1% tax is your natural starting point.

Do you want liability protection, a stronger brand, or investors? If yes, register LLC in Georgia and enjoy the reinvestment advantage built into the Georgia corporate tax rate.

Is your product truly software or IT? If yes, prepare a strong Georgia Virtual Zone application and enjoy 0% corporate on foreign IT income.

Mistakes that cost real money

Invoicing before you register. That revenue can default to 20% instead of Georgia 1% tax.

Assuming any activity fits SBS Georgia. The exclusions are real. Check your code list before you apply.

Ignoring the bank choice. The wrong bank can block payments for weeks. The best bank in Georgia for foreigners is not the same for everyone.

Applying for Georgia Virtual Zone with vague documents. Say software. Prove software.

Forgetting VAT admin on purchases. Some bills trigger reverse VAT. Set the workflow early and georgia vat refund is just a form, not a fire drill.

Keep this list close. It is short because the system is simple. Do the simple things right and Georgia treats you well.

Day 2 Action Step

Pick your structure today.

If you are freelancing and lean, choose Individual Entrepreneur Georgia and claim Georgia 1% tax under SBS Georgia.

If you are building a proper company, register LLC in Georgia and use the reinvestment rule in the Georgia country corporate tax rate to your advantage.

If you are in IT, SaaS, AI, or blockchain, go for the Georgia Virtual Zone and keep corporate tax at 0% on foreign IT income.

Tomorrow is Day 3. We will secure your Taxpayer Identification Number. The TIN is the key for invoices, for banking, and for official operations. No TIN, no movement. With a TIN, your setup becomes real.

Final word. Pick the smart path now

This is the step where disciplined founders save thousands.

The Georgia 1% tax regime is powerful, but it is not for every business. The LLC path builds trust and protects you, but it asks for grown-up accounting.

The Georgia Virtual Zone can be a dream for IT, but only when your product is truly software and your application is strong.

If you want a shortcut without mistakes, work with a team that lives this every day.

From company formation Georgia to register LLC in Georgia, from SBS Georgia small business status to Georgia Virtual Zone applications, from picking the best bank in Georgia for foreigners to handle a fast Georgia vat refund process, we guide the setup and keep you focused on work that pays.

What’s Next: Day 3 — TIN

You’ve now picked your structure: Individual Entrepreneur Georgia with 1% tax, a solid LLC in Georgia, or the powerful Georgia Virtual Zone.

But tomorrow we hit the gatekeeper. The thing without which your setup is just words on paper: the Taxpayer Identification Number (TIN).

No TIN means:

You can’t open a bank account.

You can’t invoice clients officially.

You can’t even file your Georgia 1% tax declaration with the Revenue Service.

It’s the small number that gives your business life in Georgia.

Day 3 of the 7 Days Business Setup in Georgia series will show you exactly how to get it, what documents you need, and the common mistakes that cause entrepreneurs to wait weeks instead of days.

Ready to move? Don’t miss tomorrow: How to Get Your TIN in Georgia and Start Operating for Real.