Who Should Consider Georgia’s Virtual Zone: Best Use Cases for SaaS, Software, and IT Agencies

- Tinatin Tolordava

- Aug 22, 2025

- 9 min read

Why the Virtual Zone Matters

Taxes can feel like a punishment for success.

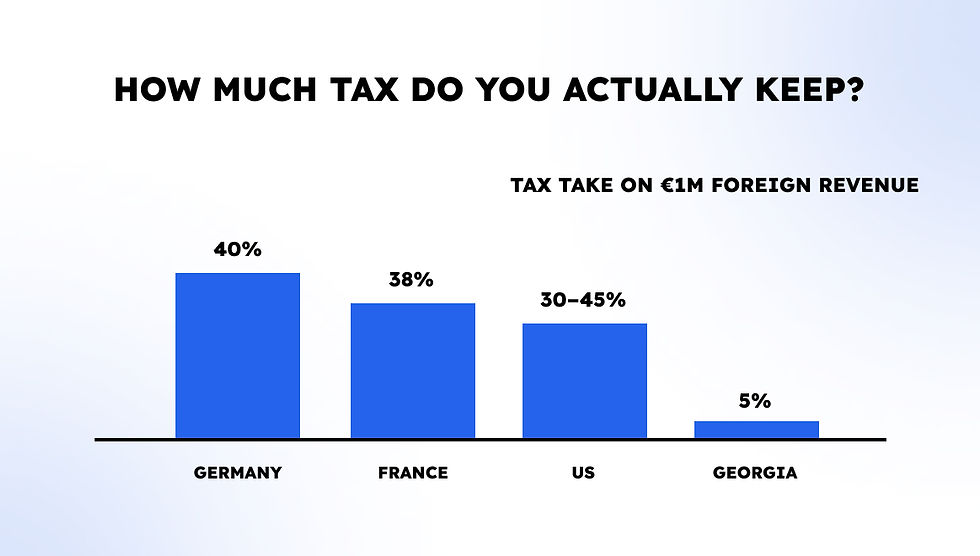

You spend months coding, building your SaaS, or growing your IT agency. Clients abroad start rolling in. Revenue climbs. Then, the tax bill lands. In Germany that could be 30%. In France nearly 40%. In the US, depending on state and federal rates, you might lose close to half.

Georgia’s Virtual Zone flips that story.

Instead of draining profits, it protects them. With this status, your company pays 0% corporate income tax on foreign revenue. There’s 0% VAT on exported IT services. The only tax left is a flat 5% on dividends when you pay yourself or shareholders.

That’s the difference between losing €400,000 on €1 million in revenue, and keeping €950,000 to reinvest. Salaries, product development, marketing campaigns, the money stays in your company, not in the hands of another government.

But the Virtual Zone is not for everyone.

A Georgian restaurant won’t qualify. Real estate agencies working with local apartments in Tbilisi won’t benefit. Even freelancers sometimes do better with the Individual Entrepreneur (IE) status that taxes turnover at only 1%.

The real winners are SaaS founders, software development agencies, and IT consultants who export their services globally.

What Exactly Is the Virtual Zone?

The Virtual Zone is not a loophole. It is a legal tax regime created by Georgia to attract IT businesses.

Here’s what makes it stand out:

0% corporate income tax on profits earned outside Georgia.

0% VAT on IT services sold to foreign clients.

5% dividend tax when profits are distributed.

Compare that to a standard Georgian LLC. Without Virtual Zone status, you face:

15% corporate income tax on distributed profits.

18% VAT on services.

5% dividend tax.

That’s a massive gap.

Imagine you invoice €1 million from clients in Germany and the US. A regular LLC might lose €200,000 or more to tax. A Virtual Zone company? Just €50,000 in dividend tax. The other €950,000 stays in play.

The approval process

The setup is simple.

Step one: register a Georgian LLC. You’ll need founding documents translated into Georgian, a legal address, and registration with the National Agency of Public Registry.

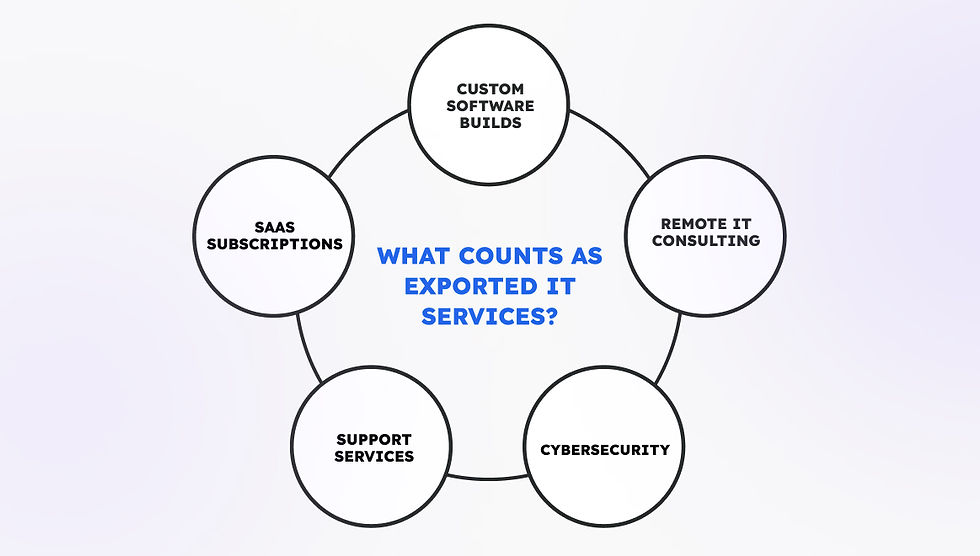

Step two: apply to the Ministry of Finance for Virtual Zone Person status. If your business is IT-related, SaaS, development, consulting, support, or cybersecurity, approval often arrives within 10 working days.

Step three: operate like any Georgian company. You file monthly tax reports with the Revenue Service Georgia, even if the liability is zero. Transparency is key.

This clarity is one of the Virtual Zone’s strengths. Unlike offshore havens that spark suspicion, Georgia offers a transparent, recognised, and government-backed system. Clients see your invoices from a credible jurisdiction. Banks trust your paperwork. Investors know the tax status is stable.

Why SaaS Companies Are the Perfect Match

SaaS businesses and Georgia’s Virtual Zone are a perfect pair.

SaaS revenue almost always comes from abroad. Customers sign up through recurring subscriptions. Payments flow from the US, the EU, Asia. That means nearly all revenue qualifies as exported IT services.

Under Georgian law, that revenue is exempt from corporate tax and VAT. The only tax you pay is the 5% dividend when you take money out of the company.

Let’s put that into perspective:

A SaaS founder in London earns €500,000 in annual subscription revenue.

In the UK, they might hand over 25% in corporate tax, €125,000 gone.

In Georgia’s Virtual Zone, the same founder would pay only €25,000 in dividend tax.

That’s a difference of €100,000 kept inside the business.

That money could fund:

Three new developers.

A major push into the US market.

An entire year of marketing budget.

The tax savings aren’t just numbers. They are growth, jobs, and opportunities that fuel expansion.

SaaS also benefits from simplicity. Subscription revenue is predictable, which makes Georgian compliance straightforward. Monthly filings with the tax authority are clean and transparent. No messy VAT complications. No heavy corporate tax calculations.

And then there’s the lifestyle advantage. Many SaaS founders prefer working remotely. Tbilisi and Batumi have become hubs for digital entrepreneurs thanks to low living costs, fast internet, and a growing expat community. Imagine scaling your SaaS, keeping most of your revenue, and living in a city where your costs are a fraction of what they’d be in Western Europe.

Why Software Development Firms Benefit

Software development firms face constant pressure on margins.

They compete with agencies in India, Eastern Europe, and Latin America. Pricing needs to stay sharp, while salaries for good developers keep rising. Add a 15% corporate tax bill, and suddenly the math doesn’t work.

That’s where the Virtual Zone steps in.

When a Georgian dev shop provides services to clients abroad, that work is treated as an exported IT service. It qualifies for the 0% corporate income tax and 0% VAT exemptions.

Let’s say your firm in Tbilisi has 20 developers working on contracts for German startups and US enterprises.

Without Virtual Zone status, profits shrink by 15% at distribution. With Virtual Zone approval, those same profits stay intact until you choose to pay dividends.

Even then, the tax is capped at 5%.

That difference can fund expansion. Instead of losing cash to tax, agencies can:

Hire more developers.

Offer competitive salaries to retain talent.

Open a second office in Batumi to access a fresh talent pool.

There’s also the matter of reputation. Clients in the EU or US often hesitate when they see offshore jurisdictions on contracts.

Georgia avoids that stigma. It is transparent, connected to European business networks, and supported by double tax treaties.

Your clients know your setup is legitimate, which makes contract negotiations smoother.

For mid-sized agencies processing millions in revenue, the Virtual Zone is not just a nice-to-have. It’s a competitive edge.

IT Consulting and Support Agencies

The benefits of the Virtual Zone aren’t limited to SaaS or coding agencies. IT consulting and support firms also qualify.

Think about businesses offering remote cybersecurity, cloud migration advice, or IT systems management. Their clients are usually abroad. Their services are delivered digitally. This makes them the perfect candidates for Georgia’s Virtual Zone.

Take a Georgian consulting firm that handles cybersecurity audits for corporations in the US. Under normal tax regimes, profits would face corporate tax plus VAT complications. With Virtual Zone status, those same profits face no corporate tax and no VAT. Only a 5% dividend tax applies when the firm distributes income to its owners.

That efficiency frees up capital. Consulting firms can reinvest in staff certifications, purchase advanced security tools, or grow their international marketing footprint.

For support agencies, the benefits are similar. Managed service providers billing monthly retainers to EU and US clients can run their operations lean. Predictable revenue meets a predictable tax structure, one that doesn’t eat into their margins.

How Does the Virtual Zone Compare to Other Georgian Tax Structures?

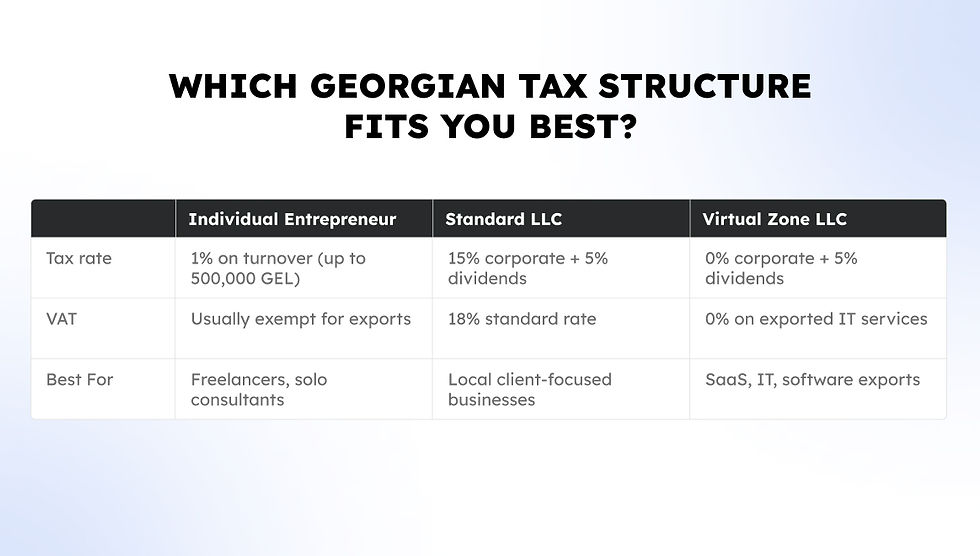

Georgia doesn’t only offer the Virtual Zone. Several tax regimes coexist, each designed for different business sizes and needs. Understanding how they compare helps founders choose the right fit.

The most popular alternative is the Individual Entrepreneur (IE) with Small Business Status.

Here, freelancers and solo consultants pay just 1% tax on turnover up to 500,000 GEL (around €170,000).

This is unbeatable for solo freelancers or very small teams. But once revenue passes that threshold, or when a founder starts scaling with employees, the Virtual Zone quickly becomes more attractive.

Another option is the standard LLC without Virtual Zone approval.

This structure is common for businesses that serve local Georgian clients. But it carries heavier tax obligations: 15% corporate income tax, 18% VAT, and 5% dividend tax. For companies with mostly foreign clients, it makes little sense compared to the Virtual Zone’s 0% model.

Finally, there’s the International Company Status, introduced for larger IT firms with significant headcount in Georgia. It offers a reduced 5% corporate tax and exemptions on some employee-related taxes. This is ideal for big outsourcing providers or global firms that want a real physical presence in Georgia. But for leaner SaaS startups or agencies without hundreds of staff, the Virtual Zone is far more efficient.

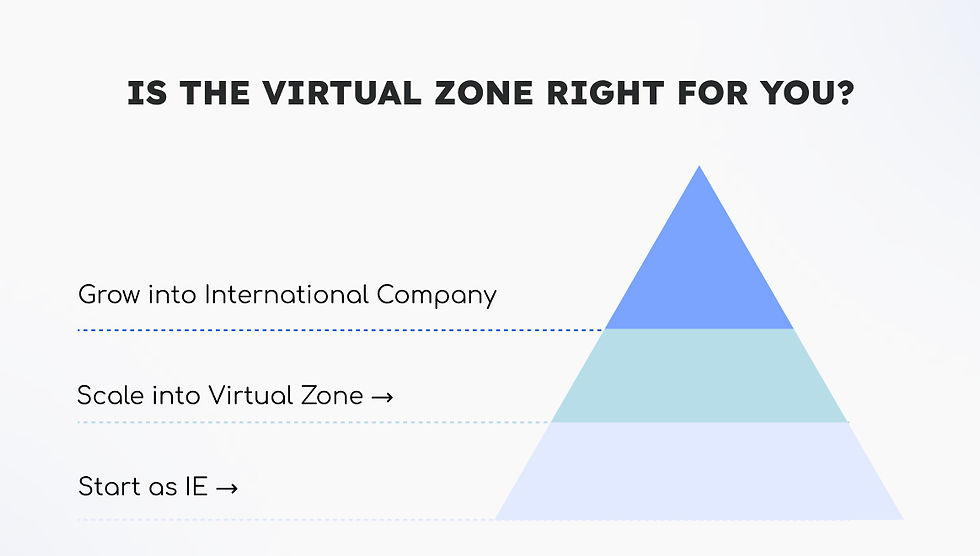

In short:

Freelancers: IE with 1% tax.

Mid-sized SaaS and agencies: Virtual Zone with 0% corporate and VAT.

Large firms with offices in Georgia: International Company status.

Where Tax Residency Comes In

Company structure is one side of the equation. The other is personal tax residency.

If you register a Virtual Zone LLC but continue living in Germany or the US, your home country might still try to tax your dividends. That’s where Georgian tax residency becomes powerful.

Georgia allows individuals to qualify for residency if they spend 183 days in the country during a year.

High-net-worth individuals can also qualify through the special High Net Worth program, which requires proof of income and assets. Once tax residency is secured, individuals pay taxes under Georgian rules. For dividends, that’s just 5%.

This combination, a Virtual Zone company plus Georgian tax residency, creates one of the cleanest setups available for IT founders. Business income from abroad faces 0% corporate tax. Personal dividends are taxed at 5%. There are no wealth taxes, no inheritance taxes, and no hidden surcharges.

That clarity is rare in global tax planning. For many entrepreneurs, it means finally being able to grow their business without feeling like they’re navigating a minefield of double taxation.

When the Virtual Zone May Not Be the Best Fit

Not every business will benefit. The Virtual Zone has specific use cases.

If your company’s revenue comes mostly from Georgian clients, you won’t qualify. The tax benefits only apply to exported services. Selling apps or consulting locally? That income is taxed differently.

Small-scale freelancers also might not need it.

If you’re earning less than 500,000 GEL annually, the IE with 1% tax is simpler and cheaper. Many designers, translators, and one-person IT consultants choose that path instead.

And for very large firms, the International Company Status often provides stronger long-term benefits. Especially when you employ dozens of staff locally, its reduced payroll taxes can outweigh the Virtual Zone’s advantages.

The key is choosing the right tool for the right situation. That’s where structured advice makes a difference.

Practical Setup Tips for the Virtual Zone

The process to set up is simple, but the details matter.

You’ll need:

A Georgian LLC registered with the National Agency of Public Registry.

Founding documents translated into Georgian.

A legal address in Georgia.

Registration with the Revenue Service Georgia for tax reporting.

An application for Virtual Zone Person status with the Ministry of Finance.

Most founders open accounts with the Bank of Georgia or TBC Bank.

Foreigners can open accounts easily, but banks often require certified translations of passports, company charters, and powers of attorney.

Using a professional English to Georgian translator ensures documents are accepted without delays.

Once the company is active, compliance is ongoing. Even if no taxes are due, you must file monthly declarations. Missing filings can trigger penalties. Many founders work with local accountants or service providers to keep everything clean.

Why This Matters for SaaS, Agencies, and IT Firms

The Virtual Zone is not just a tax break. It’s a growth tool.

For SaaS founders, it means being able to pour revenue back into product development and marketing. For agencies, it secures margins in an industry where pricing pressure is constant. For consultants, it creates predictable structures where profits don’t evaporate.

It also builds trust with clients. A Virtual Zone company is a Georgian LLC — a recognised, EU-friendly structure backed by Georgian law. Invoices carry weight. Contracts hold up internationally. Banking is modern and reliable.

And unlike offshore jurisdictions with reputational risks, Georgia positions itself as a legitimate hub for IT. That matters when pitching enterprise clients or negotiating with investors.

How Gegidze Helps

Setting up in Georgia is straightforward, but doing it right is another story. That’s where Gegidze comes in.

We handle the steps that slow founders down:

Company registration.

Certified translations into Georgian.

Bank account opening at major Georgian banks.

Payroll setup for employees.

Tax residency planning for founders.

Ongoing compliance with the Revenue Service.

Our team doesn’t just push paperwork. We make sure your structure is future-proof. Whether you start as a SaaS founder with €200,000 ARR or scale into a multi-million agency, we adapt the setup so you stay compliant and efficient.

Think of it this way: the Georgian Virtual Zone gives you the tax benefits. Gegidze makes sure you can actually use them.

Curious whether the Virtual Zone is the right fit for your SaaS, software firm, or IT consultancy?

We’ll review your business model, compare it with other Georgian tax options like IE or International Company, and show you the clearest path to saving taxes while staying fully compliant.

Frequently asked questions (FAQ)

What are the main tax benefits of Georgia’s Virtual Zone?

Virtual Zone companies in Georgia enjoy 0% corporate income tax on foreign revenue, 0% VAT on exported IT services, and only 5% dividend tax. Compared to the standard Georgian LLC corporate income tax rate of 15%, this structure keeps significantly more profit in your business.

Is the Virtual Zone better than registering as an Individual Entrepreneur in Georgia?

It depends on revenue. Freelancers earning under 500,000 GEL often do better with Individual Entrepreneur small business status, paying just 1% tax. Once your income grows or you build a team, a Virtual Zone LLC becomes more attractive because of its 0% corporate income tax and VAT exemptions.

Do I need Georgian tax residency to benefit from the Virtual Zone?

Your company benefits from Virtual Zone status regardless of your personal tax residency. But if you want to optimise personal taxes on dividends, becoming a Georgian tax resident helps. As a resident, dividends are taxed at only 5%, compared to higher rates in many other countries.

Which businesses qualify for Georgia’s Virtual Zone status?

Virtual Zone status is designed for SaaS companies, software development firms, IT agencies, and consulting businesses serving foreign clients. Revenue must come from exported services, not from Georgian customers.

Can foreigners open a Virtual Zone company in Georgia?

Yes, foreigners can register an LLC, apply for Virtual Zone status, and open a bank account in Georgia. You will need certified translations of your documents into Georgian, and it’s often easier to work with a professional translator or agency to avoid delays with the National Agency of Public Registry and local banks.