Georgia’s IT Tax Regime vs Other Tech-Friendly Countries: Why Companies Are Relocating Here

- Tinatin Tolordava

- Aug 17, 2025

- 9 min read

Table of contents

Georgia’s IT Tax System Is Making Noise for a Reason

Tech founders are tired. Tired of overpaying, over-reporting, and under-benefiting. Whether it's the administrative bloat in Western Europe or the fine print behind "zero tax" in Dubai, entrepreneurs have started looking for a smarter setup.

Enter Georgia.

This small country between Europe and Asia has quietly become one of the most competitive tax environments for IT companies. It’s not just about the low rates. It’s the structure. The clarity. The speed. And yes, the fact that you can pay 1%, 5%, or even 0% depending on how your business is set up.

Startups, agencies, and solo developers are all landing here. And Gegidze, a firm that’s helped hundreds make that move, is right in the middle of this shift.

Three Clear Models: 1%, 5%, or 0%

You choose your structure in Georgia. Not the other way around.

The government offers three tax setups that IT businesses can use, depending on size, revenue, and hiring plans:

1% turnover tax under Small Business Status (for Individual Entrepreneurs)

5% corporate tax under International Company Status (for LLCs)

0% corporate tax under Virtual Zone Status (for LLCs)

Each regime is governed by published tax codes. You apply online through public platforms like the Revenue Service Portal (rs.ge). No need to hide money. No need to chase tax treaties. Just file properly, and you’re good.

Even better: You don’t need to live in Georgia to use the system. Remote company registration is possible. Many of Gegidze’s clients operate entirely from abroad while staying fully compliant.

Individual Entrepreneur with Small Business Status (1%)

Who it's for

This model is built for people who work alone. Think freelance developers, marketers, consultants, copywriters, and product designers.

If your work is digital, and your clients are outside Georgia, you probably qualify.

How it works

You register as an Individual Entrepreneur (I.E.)

You apply for Small Business Status via rs.ge

You pay 1% of your total turnover, capped at 500,000 GEL per year (about $185,000)

You file monthly declarations

You pay the tax due by the 15th of the following month

That’s it.

There are no corporate income taxes. No dividend taxes. No mandatory social security payments. You keep almost everything you earn.

Real numbers

If you invoice $80,000 in a year, you pay $800 in taxes.

If you invoice $180,000, you pay $1,800.

No deduction gymnastics. No questions about profit. No “what counts as a business expense?” conversations. You just pay 1% of what you make.

What you can’t do

You can’t hire full-time employees under this structure.

If you’re planning to build a team or scale beyond yourself, the 1% model won’t work long term. You’ll need to graduate to a Limited Liability Company (LLC).

Virtual Zone Status (0% Tax)

A structure made for software exporters

Georgia’s Virtual Zone Status is tailor-made for one type of business: software development companies that export their services.

This includes:

SaaS businesses

Custom software developers

AI product companies

Dev shops

App builders

White-label IT service providers

If your product or service is digital and your clients are not in Georgia, this is likely the best path.

How it works

You register a Georgian LLC

You apply for Virtual Zone Status through the Ministry of Finance

If approved, your company pays 0% corporate income tax on foreign-source income

You still pay salary tax if you employ anyone in Georgia. You still submit monthly filings. But your profit stays untaxed, as long as it comes from software exported abroad.

The catch?

You need to follow compliance rules, including:

Monthly VAT and income declarations (even if you owe zero)

Annual balance sheets

Keeping contracts and invoices in proper format

Filing through the Revenue Service Portal

It’s not difficult. But it’s not casual either. That’s why most founders work with legal partners like Gegidze to stay compliant and audit-ready.

How fast is it?

You can get Virtual Zone approval within 7–10 business days if your paperwork is in order. But don’t expect help from government agencies, navigating rs.ge is hard if you don’t read Georgian. That’s where legal professionals come in.

International Company Status (5%)

Built for tech companies that want to scale in Georgia

The International Company model is designed for companies that go beyond solo work. If you’re planning to hire employees in Georgia, rent an office, or build long-term operations here, this regime is designed for you.

To qualify, your LLC must:

Operate in an eligible sector (primarily IT or maritime)

Have at least 2 local employees

Earn at least 100,000 GEL annually

Be managed from Georgia with a registered address

Once approved, you get serious benefits:

5% corporate tax on distributed profits

0% dividend tax for owners

5% personal income tax for employees (instead of 20%)

This isn’t a tax dodge. It’s a legitimate legal status backed by tax law and supported by the Revenue Service. And unlike Dubai’s “zero tax” promise, it comes with actual structure and digital filing.

Why go for this status?

Because once you start hiring locally, the 1% model becomes impossible. And Virtual Zone Status doesn’t offer the same payroll and dividend advantages.

This structure is ideal for agencies, dev teams, and fast-growing startups.

Key Differences Between the Three

Who should use what?

Business Size | Recommended Structure |

Solo / Freelancer | I.E. with Small Business Status |

Small Product Team (No local hires) | LLC with Virtual Zone |

Scaling Company (Local hires) | LLC with International Company Status |

What are the core differences?

Feature | 1% Regime | Virtual Zone | International Company |

Entity Type | I.E. | LLC | LLC |

Corporate Tax | 0% | 0% on foreign profit | 5% |

Max Revenue | 500,000 GEL | None | None |

Payroll Option | Not allowed | Optional | Required |

Local Employees | Not allowed | Optional | Mandatory |

Compliance Needs | Low | Medium | High |

Popular With | Freelancers | SaaS, devs | Agencies, startups |

Real Benefits That Go Beyond the Tax Rate

Georgia’s tax advantages go deeper than percentages.

Fast setup

You can register a company in as little as 1 day. Virtual Zone status takes under 2 weeks. International Company Status, if well-prepared, can be secured within a month.

Remote-friendly

You can register from abroad. Open a bank account. Manage everything online. Gegidze can assist with registration, bank opening, and ongoing compliance even if you’re never in Georgia physically.

No hidden reporting traps

There are no global income declarations. You don’t need to report your personal foreign bank accounts. There’s no capital gains tax on crypto. And if you’re a tax resident of Georgia, your foreign dividends and interest are not taxed here.

Easy translations

While government websites and forms are mostly in Georgian, professionals handle translations and submission. You don’t need to use Google Translate Georgian to English for every document. (Although it helps to know basic terms.) Firms like Gegidze handle both English to Georgian and Georgian to English filings routinely.

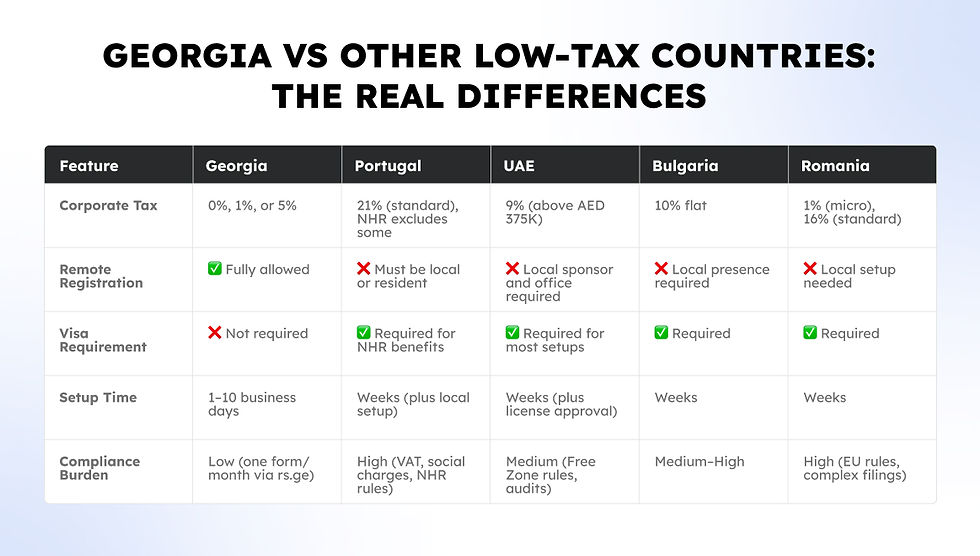

How Does Georgia Compare to Other “Low-Tax” Tech Hubs?

You’ve seen what Georgia offers. Now let’s look at how it stacks up against other popular options.

United Arab Emirates (UAE)

The UAE is often marketed as a zero-tax haven for tech startups. But that’s only partially true.

As of June 2023, the UAE introduced a 9% corporate tax on businesses earning over AED 375,000 (roughly $102,000). This change affected many small and midsize tech companies who previously relied on the zero-tax promise.

There’s still no personal income tax. But:

You must operate under a Free Zone to avoid VAT or customs headaches

Costs for setup, visas, and office space are high

You need a local presence, often with physical office leases

Compliance is more rigid than it seems on the surface

Compared to Georgia?

In Georgia, if you're under the 1% or Virtual Zone regime, you’re still paying zero to very low tax with no minimum office space, no visa requirement, and no physical presence needed.

Plus, the cost of living is dramatically lower. A remote founder can rent a full apartment in Tbilisi for the price of a hot desk in Dubai.

Portugal

The lure of NHR (Non-Habitual Residency)

Portugal offers attractive tax incentives under the NHR regime, including:

20% flat income tax for high-value professions

0% on foreign passive income (under certain rules)

But NHR:

Does not apply to corporate income

Doesn’t exempt you from VAT, dividend tax, or social charges

Is only valid for 10 years

Plus, registering a company in Portugal means:

Full accounting costs

Monthly filings with complex VAT structures

Social contributions of up to 23.75% on salaries

No equivalent of Georgia’s 1% turnover tax

For freelancers and small agencies, Georgia is far simpler. One form per month. One flat rate. One clear rule.

Romania

A rising nearshore hub, but still heavy on red tape

Romania has become a popular IT outsourcing destination thanks to its EU membership and large developer base. Tax-wise, it offers:

1% corporate tax for micro-enterprises, capped at 500,000 EUR annual turnover

16% standard corporate tax for larger companies

5% dividend tax

Sounds close to Georgia, right?

Here’s where it differs:

Romania requires minimum capital deposits for LLCs

VAT registration is required once revenue exceeds €88,500

Payroll reporting and tax filing are far more complex

EU compliance laws add extra layers of bureaucracy

Also, Romania has no virtual zone or simplified IT-specific regime.

In Georgia, you can operate an LLC with zero capital, get Virtual Zone in 7–10 days, and legally pay 0% tax on foreign software income.

Bulgaria

Simple flat tax, but limited flexibility

Bulgaria’s standout feature is its 10% flat corporate tax and 10% personal income tax.

It’s good, but not better than Georgia’s 0% or 1% options. And unlike Georgia, Bulgaria:

Requires accounting in Bulgarian

Requires physical business presence

Has more aggressive tax authority audits

Doesn’t offer IT-specific incentives

You also pay social security contributions of around 32% on employee salaries. That adds up quickly.

In Georgia, if you’re under International Company Status, employee payroll tax is just 5% flat, no additional contributions.

Real-World Use Cases

Case 1: Freelance software developer based in Berlin

Challenge: Tired of 30%+ tax on freelance income in Germany

Solution: Registers as an Individual Entrepreneur in Georgia, gets Small Business Status, pays 1% on all invoices to EU clients

Tax result: €80,000 revenue → €800 in Georgian tax, 0% in Germany due to DTA.

Case 2: Small SaaS team scaling from Armenia

Challenge: Wanted to scale operations without growing tax burden

Solution: Registers Georgian LLC, obtains Virtual Zone Status, pays 0% tax on B2B SaaS sales to US and EU

Team: Operates remotely from Yerevan, no Georgia-based staff

Compliance: Monthly filings handled by Gegidze’s tax team

Case 3: European founder building a dev agency

Challenge: Needed to hire developers legally in Georgia but avoid complex payroll

Solution: Forms a Georgian LLC, applies for International Company Status, hires 5 local devs, gets 5% personal income tax for employees

Result: Legal payroll, 5% tax on profits, full transparency for international clients

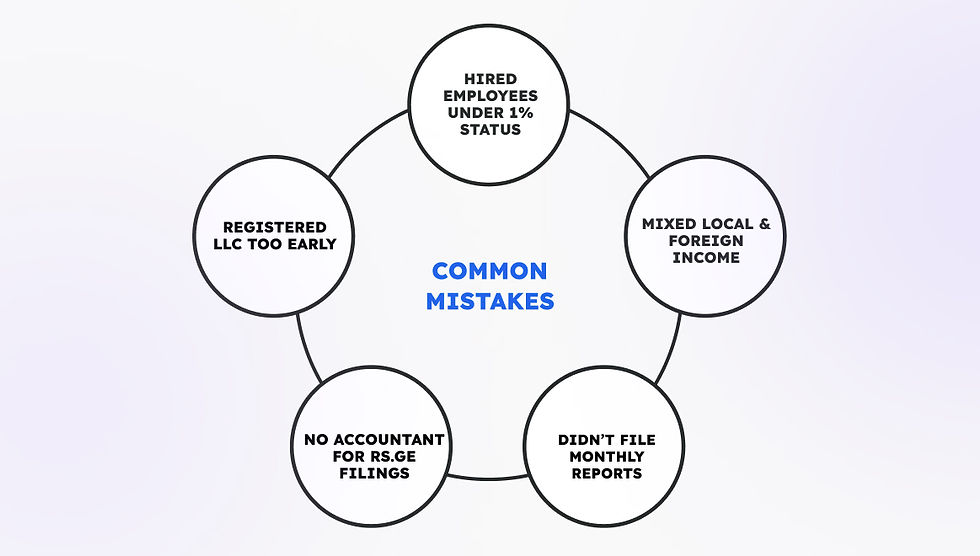

Common Mistakes to Avoid

Mistake 1: Registering an LLC when 1% status is enough

You don’t need to overcomplicate things if you’re working solo. Starting with the Individual Entrepreneur model keeps you flexible, low-cost, and fast.

Mistake 2: Trying to avoid tax without understanding source rules

Georgia only taxes source income. If you operate from abroad, file from Georgia, and get paid from overseas, you're likely in the clear. But if you live in Germany and file nothing there, you risk penalties. Gegidze helps you stay compliant in both countries if needed.

Mistake 3: Hiring employees under the 1% regime

This isn’t allowed. You can pay freelancers or contractors, but full-time employees require a legal structure like an LLC with payroll setup.

Mistake 4: Not keeping proper records

Even with 0% or 1% tax, you still need to file monthly. If you miss deadlines or file incorrectly, you risk fines. Work with someone who understands the system.

Why Tech Founders Are Relocating to Georgia

It’s not hype. It’s not loopholes. It’s smart law.

Georgia built a system that actually works for modern tech businesses.

No unnecessary taxes

Legal remote registration

Transparent filing through rs.ge

No corporate games

And support from experienced firms like Gegidze

Whether you're looking to translate your business strategy into Georgian tax code or open a company without flying in, the country’s infrastructure makes it easy. And affordable.

You don’t need to “opt in” to some niche program. The system was built this way. You just need to use it right.

At Gegidze, we help founders register, relocate, and run their businesses in Georgia without confusion or delays. From choosing the right tax regime to handling filings, payroll, and local compliance, we make sure you’re set up the right way from day one. Ready to make Georgia your base? Let’s get started.

Frequently asked questions (FAQ)

What is the best country to relocate an IT company to in 2025?

Georgia is quickly becoming one of the most tax-efficient countries for relocating IT businesses, offering 0%, 1%, or 5% tax models depending on your structure and goals.

How does Georgia’s IT tax system compare to the UAE?

Unlike the UAE, Georgia’s tax system offers lower or zero taxes without requiring expensive office space, local sponsors, or visa setups. Remote registration is fully legal.

Can freelancers really pay only 1% tax in Georgia?

Yes. Individual Entrepreneurs with Small Business Status pay 1% on turnover up to 500,000 GEL per year. This is ideal for remote freelancers working with international clients.

What is Virtual Zone Status in Georgia?

It’s a special status for IT companies that export software and services. Profits earned from foreign clients are taxed at 0% under this regime.

Is Georgia a good option for European founders?

Absolutely. With legal remote setups, DTA protection, and tax rates far lower than Germany, France, or the Netherlands, Georgia is increasingly chosen by European tech founders.