LLC vs Other Business Structures in Georgia: Which One is Right for You

- Giorgi Gamsakhurdashvili

- Jul 23, 2025

- 8 min read

Updated: Jul 24, 2025

Table of contents

Why choosing the right structure matters in Georgia

Starting a business in Georgia is fast. But choosing the wrong business structure? That can slow you down. Whether you're freelancing, launching a startup, or expanding into the Caucasus, your legal form decides how you get taxed, how you bank, and how you scale.

Georgia offers multiple business structures. Most people default to setting up a Limited Liability Company (LLC), but that’s not always the best fit. Some entrepreneurs pay more tax than they need. Others run into banking issues, get flagged during compliance checks, or have to restructure later.

This guide compares the main options: LLC, Individual Entrepreneur (I.E.), branch office, and the Virtual Zone structure. It shows how each fits different use cases, so you can launch your business in Georgia without second-guessing your choice.

You’ll also see what structures Gegidze clients use based on their income sources, team size, and goals.

Let’s start with the most common: the Georgian LLC.

LLC in Georgia: ownership, tax, liability, and flexibility

The LLC is the most versatile company type in Georgia. It’s used by solo founders, partnerships, and growing startups. Here’s what it offers:

Ownership

A Georgian LLC can be owned by a single person or multiple shareholders. Foreigners can own 100 percent. No local partner is required. The shareholders can be individuals or legal entities, and there’s no citizenship or residency requirement.

Liability

As the name suggests, liability is limited. Owners are not personally liable for company debts or legal issues. This is key if you're dealing with large contracts, physical assets, or long-term leases.

Tax

LLCs are taxed at 15 percent on distributed profits only. If the company reinvests earnings or covers qualified expenses, it pays no corporate tax. Dividends face an additional 5 percent withholding tax, making the effective rate 20 percent on payouts.

Want to go deeper into taxes? Our guide on how to register an LLC in Georgia explains the full process and tax flow.

Banking

Banks in Georgia understand LLCs well. You can open multi-currency accounts, apply for merchant services, and set up recurring business payments. Some banks may request more documentation for foreign-owned LLCs, but the process is manageable.

Other benefits

Eligible for Virtual Zone tax exemptions if working in IT

Can hire employees and issue work contracts

Can apply for VAT registration

Allowed to work with both Georgian and foreign clients

An LLC is ideal if you need limited liability, want to reinvest profits, or are building a team.

Individual Entrepreneur (I.E.): when simplicity works best

Not everyone needs a company. Georgia offers an alternative called Individual Entrepreneur, or I.E., that’s built for small-scale service providers, consultants, and solo freelancers.

Who qualifies

Any individual with a valid passport can register as an I.E. You don’t need employees, an office, or a large budget.

Tax

If your annual turnover is below 500,000 GEL and your activity qualifies, you can apply for Small Business Status. That gives you a flat 1 percent tax on revenue. No corporate tax. No dividend tax. Just a simple monthly declaration and a flat payment.

Liability

Unlike LLCs, I.E.s don’t have limited liability. You are personally responsible for business debts. For many freelancers, that’s not a concern — but if you’re taking financial risks or signing contracts, it’s worth thinking about.

Banking

Most banks allow I.E.s to open business accounts. However, compliance checks are stricter than for LLCs. If you receive large foreign transfers, the bank may ask for more documents. Gegidze helps I.E. clients avoid banking freezes by preparing invoices, agreements, and transfer justifications in advance.

Limitations

Some professions (like lawyers or accountants) are excluded

If you go over 500,000 GEL in revenue twice in 3 years, your status is revoked

You can’t apply for Virtual Zone status

You can’t onboard employees easily

Still, if you’re a solo operator earning under the limit, the I.E. structure is unbeatable. It’s fast, simple, and legal.

Branch office vs subsidiary: what foreign companies need to know

If you already have a company abroad, you don’t need to set up a new LLC from scratch. Georgia allows you to register a branch office or a subsidiary.

Here’s the difference:

Branch office

This is an extension of your foreign entity. It operates under the name of your existing company. You remain legally and financially responsible for its actions in Georgia. A branch must be registered with the National Agency of Public Registry, and you’ll need to appoint a local representative.

Branches are typically used by companies that want to test the Georgian market without forming a full entity.

Subsidiary (LLC owned by a foreign company)

This is a standalone LLC, but its sole shareholder is your foreign company. The subsidiary has its own tax ID, banking, and legal responsibility. It can contract locally and apply for tax incentives.

Subsidiaries are better for long-term operations, large teams, or when you want to separate risk.

Both options require legal documentation and power of attorney. Gegidze assists foreign companies with the paperwork, banking setup, and compliance management.

Comparison table: LLC vs I.E. vs Branch vs Virtual Zone

Here’s a clear breakdown of the main structures foreign entrepreneurs consider in Georgia:

Structure | Tax Rate | Liability | VAT Threshold | Staff Allowed | Setup Time |

LLC | 15% on distributed profit + 5% dividend | Limited | 100,000 GEL/year | Yes | 1–2 days |

I.E. (Small Business Status) | 1% on turnover (up to 500,000 GEL) | Personal | Not applicable | No | Same day |

Branch Office | Same as parent company | Parent liable | 100,000 GEL/year | Yes | 2–3 days |

Virtual Zone Entity | 0% on foreign IT services | Limited (via LLC) | Not applicable | Yes | 3–4 days |

The Virtual Zone status deserves its own mention. It’s not a company type but a tax exemption granted to Georgian LLCs that provide software development or IT services to foreign clients. If you qualify, your foreign income is tax-free, and you still benefit from local compliance.

Which is best for tech startups?

If you're building a SaaS company, digital product, or remote tech team, start with an LLC. It gives you:

Eligibility for Virtual Zone status

Limited liability

Flexibility to onboard employees or scale

Clear banking and invoicing setup for foreign clients

Tech founders often reinvest their income during the first few years. Georgia’s tax system rewards that. No corporate tax until profits are taken out.

You can still combine the LLC with a personal I.E. status for consulting work, but it’s best to keep your main product business under an LLC.

Which is best for freelancers or consultants?

If you’re a solo professional earning under 500,000 GEL, register as an Individual Entrepreneur and apply for Small Business Status. You’ll pay 1% on revenue and have almost no overhead.

Consultants, designers, developers, marketers, and coaches thrive under this setup. You can invoice clients abroad, receive payments directly, and submit simple monthly filings through the Revenue Service portal.

If you start earning close to the cap or hire subcontractors, Gegidze can help you switch to an LLC later.

Legal and tax implications of each structure

Here’s what you need to understand before choosing:

LLCs are legal persons. They can sue or be sued, own assets, hire staff, and distribute dividends.

I.E.s are individuals. You sign everything personally and are legally responsible for business debts.

Branches do not shield your foreign parent company from liability. Any legal or tax issue in Georgia can impact your headquarters.

Virtual Zone status does not override your company structure. It’s a layer on top of an LLC that grants tax benefits.

From a tax perspective:

I.E. status is simplest and cheapest if you qualify.

LLC gives you more flexibility, especially with partners or staff.

Virtual Zone reduces income tax to zero on eligible services.

Branches can complicate tax filings due to cross-border rules.

Gegidze helps clients file monthly tax declarations, register staff, manage VAT, and keep banking in sync with Revenue Service expectations. Each structure comes with its own obligations, so choose one you can actually manage.

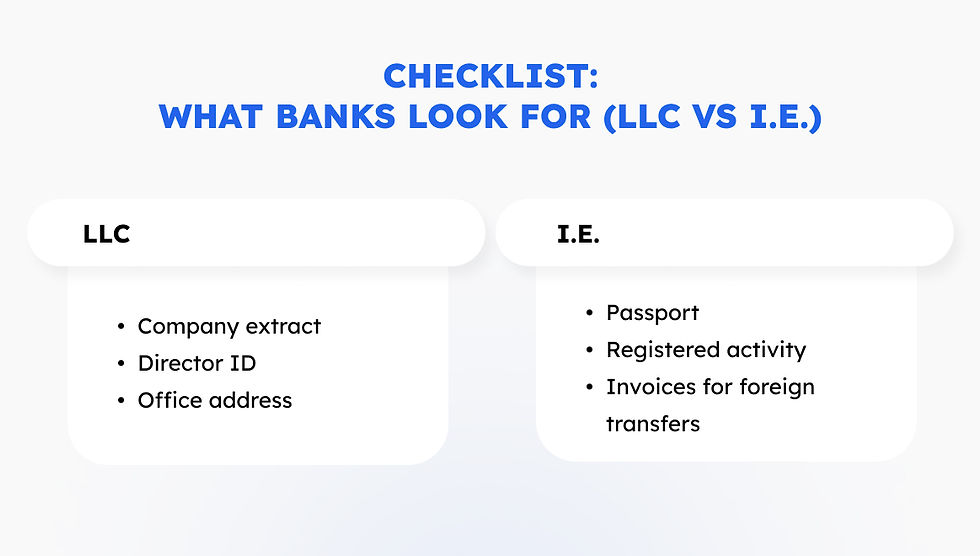

Banking and compliance per structure

Banking in Georgia is straightforward, if you know what the bank wants.

LLC bank accounts:

Allow multi-user access and recurring payments

Support local and foreign currency

Are monitored for large transfers and compliance alerts

I.E. accounts:

Function as business accounts but are held in your personal name

Often flagged if income spikes or purpose is unclear

Require you to submit invoices, contracts, and tax filings regularly

Branches and subsidiaries:

Must submit translated and notarized corporate documents

Sometimes need power of attorney for account access

Get evaluated more closely during onboarding

Whatever structure you choose, keeping your banking clean is essential. Read our full guide on banking compliance in Georgia to stay ahead of reviews and flags.

How to switch structures if your business grows

You’re not locked in forever. Many freelancers start as I.E.s and later form LLCs when they:

Hire their first employee

Cross the 500,000 GEL turnover limit

Apply for investment

Need to invoice under a business name

Switching from I.E. to LLC involves closing your individual registration and creating a new legal entity. The process takes 1–2 business days with support from Gegidze.

You can also dissolve an LLC and register as an I.E. if you downsize or pivot to solo work. However, this has tax consequences, especially if there are retained profits.

We always recommend speaking to a Georgian tax advisor or our legal team before making changes. Once you switch, your tax filing rules and banking behavior will change too.

Final verdict and how Gegidze can help

There’s no one-size-fits-all answer to structuring your business in Georgia. But here’s a shortcut:

Choose I.E. with Small Business Status if you’re solo, under the revenue cap, and want 1% tax with minimal overhead.

Choose an LLC if you’re working with partners, want to hire staff, or plan to reinvest profits.

Consider a branch or subsidiary if you’re expanding from abroad.

Add Virtual Zone status if you’re in IT or software services and want to eliminate income tax on foreign clients.

Gegidze helps you choose and set up the right structure from day one. We handle:

Company registration or I.E. setup

Small Business Status applications

Bank account opening and compliance prep

Tax residency and monthly declarations

Translations, notary, and legal guidance

Want to avoid structure mistakes and pay only what’s required?

Book a free consultation today. We’ll help you launch smart, stay compliant, and grow faster in Georgia.

Frequently asked questions (FAQ)

What’s the difference between an LLC and an Individual Entrepreneur in Georgia?

An LLC is a separate legal entity with limited liability and 15 percent tax on distributed profits. An Individual Entrepreneur (I.E.) pays 1 percent tax on revenue but has personal liability.

Who should register as an Individual Entrepreneur (I.E.) in Georgia?

Freelancers, consultants, and solo business owners earning under 500,000 GEL per year benefit most from the I.E. structure due to its 1 percent tax rate and simple setup.

Can a foreigner open an LLC or I.E. in Georgia?

Yes. Foreigners can own 100 percent of a Georgian LLC or register as an I.E. without a local partner or residency status.

What is the Virtual Zone and how does it relate to LLCs?

Virtual Zone status is a tax incentive for Georgian LLCs offering IT services to foreign clients. It reduces income tax on exports to zero. Only LLCs can apply.

Can I change my business structure later if my company grows?

Yes. You can switch from I.E. to LLC or restructure based on income and staffing. Gegidze helps with the process, paperwork, and compliance planning.