How to Structure International Business Operations for Tax Efficiency in Georgia

- Tinatin Tolordava

- May 23, 2025

- 10 min read

Table of contents

Introduction

Georgia should be on your radar if you’re running an international business and considering reducing your tax burden. We’re talking about the country in the Caucasus, not the U.S. state. This is where tax efficiency meets straightforward setup. Georgia’s tax system is built to attract founders, startups, and established companies that operate globally. Whether launching a remote-first team, running a SaaS company, or consulting clients worldwide, you’ll find real advantages here.

Let’s walk through how to structure your operations for international tax planning in Georgia, from choosing the right legal entity to navigating tax statuses and banking.

Why Georgia Makes Sense for International Tax Planning

Georgia offers a territorial tax system. That’s a fancy way of saying only income earned inside Georgia is taxed. So, if your clients are abroad, your profits might not be taxed. You could be paying 0 percent corporate income tax, legally. And no, you don’t need to set up shop in a free zone, hire locals, or relocate your entire team to access these benefits. You can manage everything remotely if you plan it well.

Compared to the EU or the U.S., Georgia keeps things simple. You can register a company within a day. You don’t need a Georgian partner. You don’t even need a physical office in most cases. That alone makes it a strong alternative for entrepreneurs tired of red tape, heavy compliance costs, and unpredictable audits. Add to that a low dividend tax, fast banking, and a business culture open to foreigners, and you’ve got a real base for scaling globally.

Choosing the Right Entity Structure

How should you structure your company to get the most tax-efficient setup?

Georgia offers several types of legal entities. But three stand out for international founders:

Limited Liability Company (LLC): Most popular. Gives you flexibility and legal protection.

Joint Stock Company (JSC): Useful for companies planning to raise investment or issue shares.

Individual Entrepreneur (IE): Perfect for freelancers or solo operators. Comes with

potential access to the 1 percent tax regime.

The LLC is usually the best choice if you plan to hire a team, process international invoices, and reinvest your profits. You can own it 100 percent as a foreigner and don’t need to be a resident.

The JSC might be worth considering if you plan to raise money or build a board. But it comes with more reporting and regulation.

If you’re solo, the IE route can work well. But be careful: it has strict rules. Your revenue must stay under 500,000 GEL (~ $182,500) annually. And not every activity qualifies.

Let’s Talk Tax Status: The Key to Efficiency

Registering a business is only the beginning. You need to apply for the right status to unlock real tax benefits.

There are three main tax incentive programs in Georgia:

Virtual Zone Status

International Company Status

Small Business Status (1 percent tax)

Each has specific conditions and is designed for different business models. Here’s how they stack up.

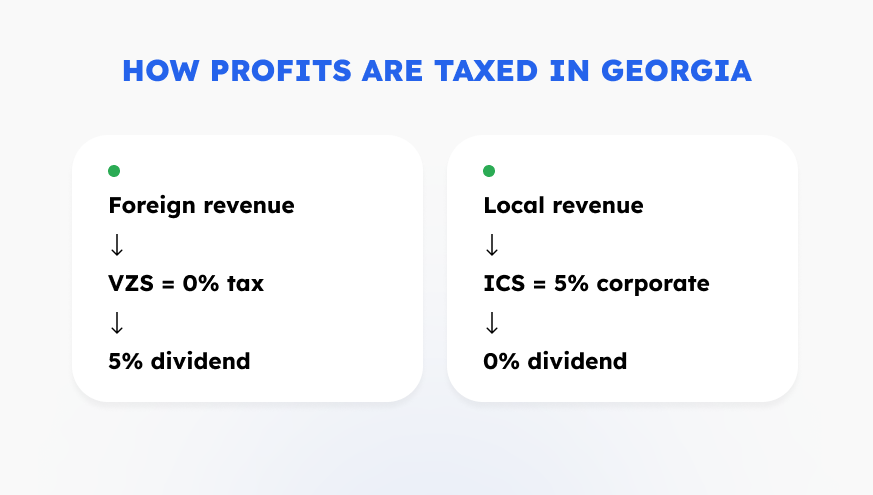

Virtual Zone Status (VZS)

This is for tech companies that serve international clients. You likely qualify if you’re doing software development, app design, IT services, or SaaS, and your clients are not in Georgia.

What you get:

0 percent corporate income tax on foreign income

0 percent VAT on exported services

5 percent dividend tax (only when you distribute profits)

You don’t need a physical office. You don’t need employees in Georgia. You can also apply online through the Ministry of Finance.

But don’t get it wrong: if you serve even one local client or sell domestically, that revenue will be taxed at 15 percent. So the structure only works if your operations are 100 percent export-based.

International Company Status (ICS)

This one’s for more mature companies. You need at least two years of experience in your field. And you must have a physical office and employees in Georgia. But in return, you get serious tax perks:

5 percent corporate tax on distributed profits

0 percent dividend tax

5 percent personal income tax for employees

0 percent property tax (excluding land)

Unlike Virtual Zone, this status allows you to earn domestic income without penalty. So if your clients are a mix of local and international, ICS might be the smarter route.

This setup requires more substance. You’ll need Georgian staff, payroll registration, and a local lease. But it’s still light compared to most countries.

Small Business Status (1 percent tax)

This is available only to registered Individual Entrepreneurs (IEs). You’ll need to operate in an approved field and keep your turnover under 500,000 GEL annually. If that’s you, you pay just 1 percent on turnover.

There is no corporate tax and no complex accounting. However, this is best for freelancers, consultants, or solo creators, not for companies with teams or complex structures.

Also, if you fail to register your status before invoicing, that income could be taxed at 20 percent. Timing matters here. You also need to renew your status yearly and file monthly reports.

Banking and Finance: How to Get Paid in Georgia

Now let’s talk money. You’ll need a business bank account to operate properly in Georgia. And the good news is, you don’t need to be a resident to open one, as long as your company is properly registered.

Most founders choose between the Bank of Georgia and TBC Bank. Both are stable and modern and offer multi-currency accounts with online banking. You can open a remote account with a power of attorney or visit once to open in person.

If your company falls under Virtual Zone or International Company Status, your bank might ask for proof, like your certificates or client contracts, especially if your revenue comes from abroad.

Business loans are available in Georgia, but mostly to companies with local operations and a stable income history. Running a lean international structure makes you more likely to bootstrap or use offshore funding.

Payroll, Dividends, and Withholding Explained

If hiring locals, you must register for payroll and withhold the proper taxes. Georgia has a flat tax system.

Employee salary tax: 20 percent

Employer pension contribution: 2 percent

Employee pension contribution: 2 percent

If your company is under ICS, the personal income tax drops to 5 percent, a huge benefit when hiring in Georgia.

As for dividends, they’re taxed at a flat 5 percent. But you only pay this when you distribute profits. Retained earnings are not taxed. This makes Georgia especially appealing for companies looking to reinvest.

Georgia also has double tax treaties with over 50 countries. If you're a resident elsewhere, you may be able to offset taxes paid in Georgia or avoid double taxation altogether. That’s where tax residency planning comes into play.

VAT and Reverse VAT: What You Need to Know

VAT in Georgia is 18 percent. However, it only applies to companies over a 100,000 GEL revenue threshold or those importing goods and services. You may be exempt if you qualify for Virtual Zone or are selling B2B digital services.

However, you may still need to file reverse VAT declarations on foreign service purchases, like Google Ads, SaaS tools, or hosting fees. This is a common blind spot for founders and something you’ll want your accountant to manage properly.

Keep It Legal: Monthly Filings and Annual Duties

Georgia’s tax system is friendly but expects you to stay compliant. The game includes monthly tax declarations, income statements, and payroll filings.

Monthly VAT reports (if applicable)

Income declarations by the 15th of each month

Annual updates to the Public Registry

If you're late or non-compliant, you can face penalties or lose your tax status. That’s why many international businesses work with local experts like Gegidze to keep everything smooth and stress-free.

Real-World Scenarios: How Companies Structure in Georgia

Let’s make this concrete. These three simplified scenarios are based on setups we've seen at Gegidze.

1. A SaaS startup serving EU clients

Founders: Remote-first teamClients: All outside GeorgiaEmployees: None in-country

This company is registered as an LLC and has applied for Virtual Zone Status. Since all its revenue came from abroad, it qualified for 0 percent corporate income tax. It opened an account with the Bank of Georgia and operates everything remotely.

No VAT. No physical office. Only a 5 percent dividend tax when profits are paid out.

2. A B2B consulting firm with clients in Georgia and abroad

Founders: UK-basedClients: Mix of Georgian and EU firmsEmployees: 3 local hires

This company applied for International Company Status, opened an office in Tbilisi, and hired locals. It now pays 5 percent corporate income tax on distributed profits and just 5 percent income tax on salaries.

They had to prove two years of experience in consulting, but once approved, they benefited from 0 percent dividend and 0 percent property tax on their office space.

3. A solo digital marketing freelancer

Founder: Works remotely from Tbilisi.

Clients: U.S. and Europe

Annual turnover: Under 500,000 GEL

Registered as an Individual Entrepreneur and applied for Small Business Status. Now pays just 1 percent of turnover as tax. That’s it. Simple setup, but it came with one condition: no revenue before official registration.

This structure is popular, but dangerous if misused. Income before SBS approval is taxed at 20 percent. We’ve helped several freelancers fix this, but it’s better not to make the mistake in the first place.

Common Mistakes That Kill Your Tax Efficiency

Georgia’s tax system is efficient only if you follow the rules. Here’s where we see international clients go wrong:

1. Starting to invoice before you register your tax status

Depending on your structure, that first invoice might cost you 20 percent tax instead of 1 percent or 0 percent. Timing is critical.

2. Assuming all income qualifies for the incentive

Selling to local clients? Using a local warehouse? That’s domestic income. And it’s taxed at 15 percent corporate income tax unless you’re under ICS.

3. Missing monthly filings

It doesn’t matter if you had no revenue that month. You still need to file. Late filings = penalties. It also puts your tax status at risk.

4. Thinking, VZS and ICS apply automatically

They don’t. You must apply, and your activity must match specific industry codes. Not all tech services qualify. Businesses have been rejected for using the wrong NAEC activity code during registration.

5. Not planning your tax residency

If you spend more than 183 days in Georgia, you become a tax resident. If not planned carefully, this could trigger taxation on worldwide income. Use this rule strategically, not accidentally.

6. Using a local team without a proper payroll setup

Even if you’re paying a contractor, the tax office might treat them as an employee if they're working full-time and using your equipment. Which means you owe payroll taxes.

Can You Manage Everything Remotely? Yes, But With Help

One of the biggest draws of structuring your operations in Georgia is the ability to run everything from abroad. You don’t need to live here. You technically don’t even need to visit. But someone still needs to handle:

Filing your monthly returns

Registering for VAT or SBS

Managing reverse VAT reports

Communicating with the Revenue Service

Filing your annual updates to the registry

That’s where having a legal and accounting team on the ground makes all the difference. At Gegidze, we offer bundled services so you don’t have to juggle multiple providers. We handle filings, translations, status applications, and compliance, all under one roof.

What About Banking Access and International Transfers?

Foreign-owned businesses in Georgia can easily open bank accounts. You must show your registration certificate, company charter, and tax ID. Sometimes, banks may ask for a brief business plan or explanation of your revenue model.

Best banks for international businesses:

Bank of Georgia: Strong online banking, multi-currency accounts, English support

TBC Bank: Great digital tools, fast customer support, efficient onboarding

Both accept foreign owners and remote setups. If you’re under Virtual Zone or ICS, your account is considered low-risk as long as your business is well documented.

Need to send or receive USD, EUR, or GBP? Not a problem. Georgian banks are connected to SWIFT and IBAN systems, and most clients can set up Wise or Payoneer accounts for extra flexibility.

Can You Get Business Loans in Georgia?

Yes, but only if you have local operations and show stable revenue. If your company is a shell with no employees and no local income, you won’t qualify. Georgian banks still prefer brick-and-mortar businesses when it comes to credit.

Some founders use Georgia for tax efficiency but keep funding and investor relationships offshore. That model works well when structured correctly.

Using Georgia for Your Holding or HQ? Yes, That Works Too

You don’t have to live or work here to benefit from Georgian structures. Many international entrepreneurs use Georgia as:

A holding company jurisdiction (0 percent tax on foreign dividends)

A client-facing HQ for service contracts

A regional office to manage teams in the Caucasus or Eastern Europe

We’ve helped EU founders relocate their main operations to Georgia while keeping staff in other countries. With the right structure, you can reduce your global tax burden while remaining compliant in multiple jurisdictions.

Can You Combine Tax Status with Georgian Residency?

Yes, and for some founders, this unlocks even more benefits. Georgia offers a simple tax residency test: 183 days in-country. Once a tax resident, you can apply for a certificate and access the country’s 50+ double tax treaties.

This is useful if you’re living in a high-tax country and want to legally shift your residency without giving up control of your company.

But it has to be planned carefully. Becoming a tax resident could also trigger taxation on personal worldwide income. It depends on your setup, the source of your dividends, and where your previous residency was.

Still Not Sure How to Structure It All? That’s Where We Come In

At Gegidze, we specialize in helping international founders structure their business in Georgia for long-term tax efficiency. Whether you're starting from scratch or looking to move your operations from another jurisdiction, we’ll help you:

Choose the right legal entity

Apply for the correct tax status (VZS, ICS, SBS)

Handle registrations and filings.

Manage tax residency questions.

Set up your local banking and payment tools.

You can register an LLC in a day. But structuring your international business for tax efficiency? That takes precision.

Talk to us if you want to do it right from day one. Book your free consultation, and we’ll help you find the smartest path forward without the bureaucracy, delays, or mistakes that have cost other founders thousands.

Get more. Pay less. Stay compliant. That’s the Gegidze way.

Frequently asked questions (FAQ)

What is the most tax-efficient way to structure a business in Georgia?

The most tax-efficient structure depends on your business model. Virtual Zone Status works best for tech companies with foreign clients, while International Company Status is ideal for those with local presence and employees.

Can I open a business in Georgia as a non-resident?

Yes. Foreigners can own 100% of a Georgian company without local partners or residency. You can manage everything remotely or with a local representative.

Do I need a physical office in Georgia to get tax benefits?

Not always. Virtual Zone companies can operate without a physical office. However, International Company Status requires a physical office and local hires.

How are dividends taxed in Georgia?

Dividends are taxed at a flat 5% when distributed. There’s no additional tax on retained earnings, making it attractive for companies looking to reinvest profits.

Can I combine Georgian tax residency with my business structure?

Yes. Spending 183+ days in Georgia qualifies you for tax residency, which may help avoid double taxation through Georgia’s treaties. This should be planned carefully with your business structure.