Crypto Payments in Georgia: Legal Rules, Taxes, and How Gegidze Makes It Simple

- Tinatin Tolordava

- Aug 26, 2025

- 13 min read

Table of contents

Introduction

In Georgia, cryptocurrency is actively shaping how companies operate.

The country has built one of the clearest legal frameworks for crypto use in Europe, mixing low taxes with straightforward compliance. Blockchain startups, Web3 projects, DAOs, and iGaming operators are finding that they can pay teams, accept investments, and run operations here without drowning in bureaucracy.

That clarity is a major advantage for founders who want to pay teams in crypto but cannot afford to get caught in legal uncertainty.

Instead of cobbling together half-compliant payment methods or relying on multiple intermediaries, they use Gegidze’s crypto payroll and Employer of Record (EOR) services to handle everything in one streamlined process: from banking and compliance to tax optimization and payouts.

Why Georgia is on the Map for Crypto Businesses

Search for crypto payments Georgia or crypto tax Georgia and you’ll see why founders are moving here. This is a country with:

0% tax on capital gains for individuals trading crypto

No VAT on crypto exchanges or conversions

A territorial tax system that ignores foreign-sourced profits

Business setup in days instead of months

The result is a growing crypto economy. Web3 projects base their developer teams here, DAOs use Georgian structures for global payouts, and foreign companies tap into the tax advantages for remote-first operations.

Is Crypto Legal in Georgia

Yes, and that is not just marketing speak.

Georgia legally allows the ownership, trading, mining, staking, and use of cryptocurrency in commercial transactions. The main limitation is that crypto is not legal tender. GEL (Georgian Lari) is the only official currency for settlement of debts and salaries.

This means:

You can’t issue an employment contract stating that the salary is payable in crypto (for example in Bitcoin)

You can still send Bitcoin to someone, but for it to be legally recognized as a salary or payment for services, it must be converted into GEL through an approved channel

The country’s Law on Payment Systems and Payment Services and the guidance from the National Bank of Georgia (NBG) make it clear: crypto payments are allowed if the final settlement is in GEL. This is why companies paying staff or contractors in Georgia use a compliant intermediary to handle the conversion.

VASP Registration and Regulation

Crypto service providers are regulated by the National Bank of Georgia under rules introduced to meet international AML/CFT standards.

Who must register as a VASP:

Crypto-to-fiat and fiat-to-crypto exchanges

Custodial wallet providers holding client funds

Platforms that trade, transfer, or manage virtual assets for clients

Who doesn’t need registration:

Individuals trading crypto for their own account

Miners and stakers who don’t provide services to third parties

Businesses that only use crypto for their own transactions (but they must still follow payment and tax rules)

If your business model involves holding or moving crypto for others, you need to be a registered VASP in Georgia. For most foreign companies simply paying salaries, the easiest option is to let a VASP and EOR handle it. That keeps you out of the licensing process entirely while still operating legally.

How Businesses Can Accept Crypto Payments

There are two main ways to handle crypto payments in Georgia without risking non-compliance:

1. Use a licensed VASP to handle the exchange

The customer pays in crypto, the provider converts it to GEL, and the business receives funds in its bank account.

2. Hold crypto but settle in GEL

The company keeps crypto on its books but must record each transaction’s GEL value. This is common for crypto-native businesses but less practical for payroll.

Gegidze’s crypto payroll solution uses the first model, ensuring every transaction is compliant, taxed correctly, and protected from volatility.

Paying Employees and Contractors in Crypto the Legal Way

While sending Bitcoin directly to an employee’s wallet might seem like the most “crypto-native” approach, it causes two significant problems.

First, it bypasses the GEL settlement requirement.

Second, it ignores payroll tax withholding rules, which can lead to fines and backdated tax bills.

The compliant route is:

Company sends crypto to Gegidze

Gegidze exchanges it into fiat

Salaries or contractor fees are paid in GEL, USD, EUR, or other major currencies with all required tax withholding

With this structure:

Employees can be hired under EOR, with access to local benefits and compliant contracts

Contractors can register as Individual Entrepreneurs and pay only 1% turnover tax

Payments can be processed not just in Georgia but worldwide, giving teams flexibility in how and where they get paid

The company avoids misclassification risks and payroll penalties

The compliant process involves sending the crypto to Gegidze, which then converts it to fiat and pays salaries or contractor fees through the Georgian banking system or international channels.

This ensures that all income is recorded, taxes are correctly calculated, and payments are legally recognized.

Through Gegidze’s global EOR network, companies can sometimes access special tax regimes in certain countries, helping clients reduce payroll costs by 10–20%.

Contractors benefit even further with Georgia’s Small Business Status, which allows them to pay only 1% on turnover.

Crypto Tax in Georgia for Individuals

Georgia’s territorial tax system means residents pay tax only on Georgian-sourced income. If your crypto profits are from trading on foreign exchanges, they are tax-free.

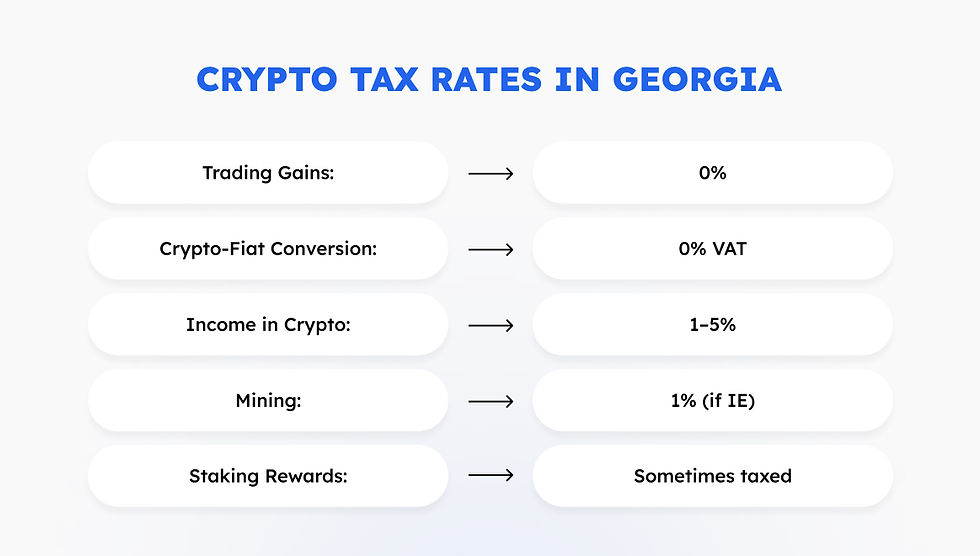

Key points:

Trading gains: 0% tax if not part of a business

Crypto-to-fiat conversions: 0% tax, no VAT

Income in crypto: taxed as salary or business income

Mining: taxed as local income (IEs can pay 1%)

Staking: occasional rewards are untaxed, but ongoing rewards are taxed as income

Example: A Georgian tax resident trading Ethereum on Binance pays no tax on gains. But if that person earns Ethereum for freelance work for a US client, they register as an IE and pay 1% turnover tax.

Corporate Tax in Georgia and Why It Favors Crypto Companies

Georgia uses what is often called the Estonian model of corporate taxation, which flips the usual tax structure on its head.

In most countries, companies pay corporate tax on profits every year, regardless of whether those profits are reinvested or distributed to shareholders.

In Georgia, corporate tax is triggered only when profits are actually distributed.

This means that if a company earns revenue and keeps those profits inside the business — for example, to buy mining equipment, expand infrastructure, or hire new developers — it pays zero corporate tax until the money is taken out as dividends.

This is especially valuable for crypto companies, where reinvestment is often essential to keep pace with technology and market changes.

By deferring the tax event, businesses preserve cash flow and can scale faster without the drag of annual profit taxation.

No VAT on Crypto Trades or Conversions

Under Georgian law, cryptocurrency is classified as a virtual asset rather than a commodity or security. As a result, converting crypto to fiat or exchanging between cryptocurrencies is exempt from Value Added Tax (VAT).

This makes Georgia far more attractive than jurisdictions where VAT or sales tax can be applied to exchange transactions, which can quickly erode profits for trading firms, payment processors, and liquidity providers.

Mining and Staking for Foreign Clients as VAT-Free Exports

When mining or staking services are provided to clients outside Georgia, the income is typically classified as an export of services.

Exports are zero-rated for VAT purposes, meaning no VAT is charged to the client, and the service provider can claim input VAT credits if applicable.

For large-scale mining operations or staking-as-a-service providers, this can translate into significant tax savings compared to operating in jurisdictions where VAT applies to all domestic and international services.

Free Industrial Zones for 0% Corporate Tax and VAT

Georgia has established several Free Industrial Zones (FIZs) in locations such as Kutaisi, Poti, and Tbilisi. Companies operating within these zones enjoy:

0% corporate income tax, regardless of profit distribution

0% VAT on goods and services provided outside Georgia

No import duties on equipment, including high-value mining rigs, cooling systems, and networking hardware

For crypto mining companies, setting up in a FIZ can almost completely eliminate operational tax costs. Equipment can be imported duty-free, electricity is competitively priced, and the corporate tax holiday applies indefinitely as long as the business remains within the zone.

When combined with Georgia’s deferred corporate tax system, VAT exemptions, and export classification for international crypto services, these advantages create one of the most tax-efficient environments in the world for blockchain and cryptocurrency businesses.

Setting Up a Crypto Business in Georgia

Company registration takes 1–2 days for most industries. Crypto companies need to decide whether VASP registration applies to them and which tax regime they want. Banking can be challenging for new crypto businesses, but Gegidze’s remote account setup solves this in 3–5 days.

Paying Your Global Team in Crypto Without the Headache

Global teams bring payroll complexity. Currency volatility, cross-border compliance, and different tax systems can turn payroll into a full-time job.

Gegidze removes the friction:

Acts as Employer of Record in Georgia

Registers contractors as IEs

Ensures correct tax rates for each worker

Handles currency conversion at competitive rates

Real-World Use Cases for Crypto Payments in Georgia

Georgia’s legal framework, low taxes, and fast business setup make it ideal for several industries that rely heavily on crypto for payments and operations. Understanding how each industry benefits provides a clear picture of why so many companies are making the move.

Web3 Development and Blockchain Startups

Web3 companies often operate in a truly borderless way, with teams spread across multiple countries. Paying contributors in fiat is expensive, slow, and can cause unnecessary currency conversion losses.

In Georgia, a Web3 startup can receive funding in crypto, convert it to fiat through a compliant channel, and pay developers in GEL, usd, eur while benefiting with the special tax rates at just for employees in the Caucasus and Central Asia or 1% for contractors.

Since blockchain development qualifies as an export of IT services, there is no VAT on international client revenue. Companies can also apply for Virtual Zone Status, which means no corporate tax at all on foreign-sourced income.

Decentralized Autonomous Organizations (DAOs)

DAOs face a unique problem. They are often not incorporated as a traditional company, yet they need to pay contributors legally to avoid future disputes and tax issues.

Georgia’s structure allows a DAO to work with Gegidze as the Employer of Record. The DAO sends crypto to Gegidze, which handles conversion, tax registration, and compliant payouts.

This avoids misclassification risks and ensures that DAO members receive official proof of income for visa, tax, or loan purposes.

iGaming and Betting Platforms

The online gaming and betting industry has always been an early adopter of cryptocurrency. Fast settlement, low transaction fees, and privacy are strong advantages.

However, in many jurisdictions, crypto payments trigger additional compliance checks or tax obligations.

In Georgia, iGaming companies serving foreign players can operate under the export of services classification, paying 0% VAT on international revenue.

By using a Free Industrial Zone, they can also eliminate corporate tax entirely. Crypto received from players can be converted to fiat for operational expenses without any VAT applied.

International Freelance Marketplaces

Platforms connecting global freelancers to clients face constant challenges with payouts. Sending bank transfers to dozens of countries can result in high fees and long delays.

By routing all payments through Georgia and paying freelancers in GEL, the platform can reduce transaction costs and give freelancers the option to register as Individual Entrepreneurs for the 1% tax regime.

Crypto can be the funding source, but payouts are made in full compliance with Georgian payroll law.

How Gegidze Optimizes Crypto Payroll for Each Case

Gegidze’s crypto payroll model is designed to handle different scenarios without forcing companies into a one-size-fits-all approach.

For a DAO, the main goal might be legal recognition of payouts. For an iGaming platform, it might be maximizing tax efficiency while remaining compliant with gambling regulations.

For a Web3 startup, it might be enabling the fastest possible onboarding of remote engineers.

The flexibility comes from two key services:

Employer of Record (EOR) for hiring employees in Caucasus & Central Asia, applying the tax exemption rates for specific industries like tech, WEB3, iGaming and etc

Individual Entrepreneur (IE) registration for contractors, applying the 1% turnover tax.

In both cases, the company can fund payroll in any major cryptocurrency, which Gegidze converts to fiat before paying out salaries or contractor fees.

Setting Up Payroll in Georgia for a Global Crypto Team

While setting up payroll in Georgia, the first step is to make sure your team is classified correctly under Georgian tax law.

Employees and contractors are taxed differently, and choosing the right category can make a big difference in cost, compliance, and benefits for your team.

Step 1 – Classify Your Team

EmployeesWhen workers are hired as employees, Gegidze becomes their legal employer in Georgia. This means:

Employment contracts that meet local labor law requirements.

Payroll and tax administration handled entirely by Gegidze.

Reduced tax rate applied automatically.

Access to official employment records, which can help with visa applications, credit checks, or mortgage approvals.

ContractorsFor contractors, Gegidze registers them as Individual Entrepreneurs. If they qualify for Small Business Status, they pay just 1% turnover tax. This setup is especially useful for:

Freelancers working on multiple projects.

Part-time contributors.

Specialists hired for fixed-term assignments.

Gegidze manages all the registration steps, so contractors can start receiving payments legally within days.

Step 2 – Send Crypto

Once classification is complete, your company sends crypto directly to Gegidze.

Any major cryptocurrency can be used.

Conversion to fiat happens at competitive exchange rates.

No VAT is applied to the conversion process.

Step 3 – Pay in GEL

After conversion, salaries and fees can be paid in GEL, USD, EUR, or other currencies, as required by law and business needs.

Payments go directly into employees’ or contractors’ bank accounts worldwide.

All tax declarations are filed with the Revenue Service for Georgian-based workers.

Your company does not need to be physically present in Georgia or open a local entity.

Compliance Considerations for Foreign Crypto Companies

Georgia welcomes crypto businesses, but “friendly” does not mean “anything goes.” If your goal is to move serious amounts of crypto without interruptions, you need to play by the rules.

AML and KYC Are Non-Negotiable

Large crypto transfers without proper AML/KYC checks will hit roadblocks.

Banks and licensed exchanges in Georgia follow strict screening.

Missing contracts, incomplete invoices, or vague payment purposes can lead to frozen transactions.

Gegidze cuts through that risk by preparing every piece of documentation before money moves. Contracts, tax IDs, payment records, all ready to satisfy both banks and regulators.

The GEL Payment Rule

Georgia is fine with you holding USD, EUR, or any cryptocurrency. But salaries? They must be paid in Georgian Lari (GEL).

If you send crypto directly, the payment will not legally count as a salary.

Conversion to GEL ensures compliance and prevents disputes with authorities.

The tricky part is currency risk. The gap between sending crypto and paying in GEL can mean unwanted losses if the market swings.

Industry-Specific Tax Planning

Different industries have different optimal tax structures in Georgia.

For example, a blockchain development firm serving only international clients might qualify for Virtual Zone Status, which removes corporate tax entirely on foreign-sourced revenue.

A large crypto exchange targeting multiple markets might opt for International Company Status to take advantage of the reduced corporate and personal income tax rates.

Crypto mining companies can gain significant benefits by locating in a Free Industrial Zone.

They can import mining equipment without paying customs duties, operate with zero corporate tax, and avoid VAT on electricity if structured properly.

By combining the deferred corporate tax system with these special statuses, it is possible for a crypto business to achieve extremely low effective tax rates while remaining fully compliant.

Different industries can unlock very different tax setups in Georgia. The trick is matching your activity to the right legal status.

Blockchain development for foreign clientsEligible for Virtual Zone Status. Corporate tax on foreign revenue drops to 0%, with no VAT on exports.

Large crypto exchangesCan apply for International Company Status. This means 5% corporate tax, 0% dividend tax, and reduced personal income tax for staff.

Crypto mining operationsHuge wins in Free Industrial Zones (FIZs). Import mining rigs duty-free, pay 0% corporate tax, and avoid VAT on electricity with the right structuring.

Common Mistakes Foreign Companies Make

Even in a crypto-friendly country, businesses still trip up, and it can be costly.

Paying salaries directly in crypto: The tax office will not recognize this as legal salary payment unless it’s converted to GEL first.

Assuming registration equals tax perks: Virtual Zone Status and International Company Status are not automatic. You need to apply and maintain compliance.

Misclassifying workers: Some companies also underestimate the importance of proper worker classification. Misclassifying an employee as a contractor to save on taxes can lead to backdated liabilities, penalties, and even legal disputes.

Gegidze’s onboarding process is designed to remove these risks entirely. Every worker is reviewed to determine the correct classification from day one.

Salaries are processed in GEL, taxes are reported on time, and all eligibility requirements for special tax statuses are managed in the background.

This allows foreign companies to benefit from Georgia’s incentives without falling into compliance traps.

Why Georgia and Gegidze Are the Ideal Combination for Crypto Payroll

Georgia offers one of the most favorable legal and tax environments for crypto businesses anywhere in the world.

It combines clear regulations, fast company setup, low taxes, and complete VAT exemptions on crypto trades and conversions.

For companies that want to pay a global team in crypto while staying fully compliant, it is hard to find a better jurisdiction.

We handle everything: remote bank account opening, employee and contractor onboarding, tax registrations, crypto-to-fiat conversions, and payroll reporting.

Through our EOR network, businesses can also access country-specific tax benefits, sometimes saving 10–20% on payroll costs. This allows companies to focus on growth, product development, and market expansion while knowing that their team is paid legally and tax-efficiently.

If you are running a blockchain startup, DAO, iGaming platform, or any global business that wants to integrate crypto into payroll without creating compliance problems, Georgia should be on your shortlist. The country’s tax incentives, legal clarity, and infrastructure make it an ideal base for modern, crypto-first companies.

Book a call with us today and see how quickly your business can start paying your team in crypto while staying compliant, reducing taxes, and operating with complete transparency.

Frequently asked questions (FAQ)

Can I pay my employees directly in Bitcoin or Ethereum?

You can send them crypto, but to be legally recognized as a salary, it must be converted into GEL before it reaches the employee’s account. This ensures proper tax withholding and compliance with the legal tender rules.

Do I need to register a company in Georgia to use Gegidze’s crypto payroll service?

No. You can use Gegidze as an Employer of Record without having a local legal entity. They handle employment contracts, payroll, and tax reporting on your behalf.

Is there VAT on crypto transactions in Georgia?

No. Converting crypto to fiat or exchanging one cryptocurrency for another is exempt from VAT.

Can crypto mining income be VAT-free?

Yes, if the client is located outside Georgia, mining services can be classified as an export of services and zero-rated for VAT.

How quickly can I start paying my team in Georgia?

Gegidze can set up bank accounts and onboard workers in as little as 3 to 5 business days.

What is the tax rate for contractors in Georgia?

Contractors registered as Individual Entrepreneurs with Small Business Status pay just 1% on turnover up to a set threshold.