Double Taxation in Georgia Explained: If You Pay Taxes Here, Do You Owe Anything at Home

- Tinatin Tolordava

- Aug 18, 2025

- 11 min read

Updated: Aug 21, 2025

Table of contents

When Worlds Collide and Taxes Follow

Picture this. You’re a digital nomadworking from a mountaintop café in Mestia, billing clients in London. Or maybe you’re a startup founder who chose Georgia for its flat 1% tax regime. Everything’s going well until one question hits you: “Do I still need to pay taxes in my home country?”

This is where the concept of double taxation steps in. It’s what happens when two countries try to tax the same income. Without proper planning, you could end up paying twice. Georgia’s legal structure helps prevent that. But only if you know how the system works.

This article unpacks Georgia’s double taxation treaties, who qualifies, how tax residency works, and what steps you need to take to protect your income legally.

What Is Double Taxation and Why It Matters

Double taxation happens when two different countries try to tax the same income. This usually affects people who live in one country and earn money from another, or who move around frequently while running a business. Here’s how it plays out:

Your home country may tax you based on residency, meaning if you’re legally considered a resident, they want a cut of all your global income.

Georgia, on the other hand, may tax you based on where the income is earned, if it’s considered sourced in Georgia, they want a share too.

When both countries claim the right to tax the same earnings, you face the risk of paying twice. This isn’t just a theoretical problem, it’s something remote workers, freelancers, and international founders deal with regularly.

That’s why Georgia has signed 58 Double Taxation Avoidance Agreements. These treaties help divide taxing rights fairly, so you’re not penalized for working across borders. They ensure that income is only taxed once, either by Georgia or by the other country, or that you receive a credit for taxes already paid.

Georgia’s Tax Rules: Residency and Territoriality

What Makes You a Tax Resident in Georgia

Georgia uses a 183-day rule to determine tax residency. If you spend more than 183 days in the country in any 12-month period, you qualify. That opens the door to its local tax benefits and lets you apply for a Georgian Tax Residency Certificate.

There are other paths too. Georgia offers high-net-worth residency to individuals with over 200,000 GEL in income or $500,000 in local assets. This alternative route allows many entrepreneurs and investors to get tax resident status without needing to live full-time in Georgia.

Territorial Taxation in Action

Georgia operates a territorial tax system. This means the country only taxes income that is sourced within its borders. If you're a tax resident in Georgia but your income is generated entirely from clients or businesses outside Georgia, you typically won’t owe local tax on that foreign-sourced income.

On the flip side, if you're not a tax resident but you earn income from inside Georgia, such as through a local contract or physical business presence, that income is still taxed locally.

So what exactly counts as Georgian-source income?

Salary paid by a Georgian employer

Payments from clients based in Georgia

Revenue connected to a permanent establishment in Georgia, like an office or warehouse

Income that comes from outside Georgia, such as freelance work for non-Georgian clients, dividends from foreign companies, or rental income from overseas real estate, is typically not taxed in Georgia. This is one of the biggest advantages for remote entrepreneurs and expats.

Understanding this distinction is critical. Many founders assume being a tax resident means global income is taxed locally. In Georgia, it’s different. The system is built to encourage international work without double taxing income earned abroad.

Georgia’s Double Taxation Treaties: What They Actually Do

Georgia has signed 58 Double Taxation Avoidance Agreements. These treaties are based on the OECD Model Convention and are designed to encourage trade, investment, and fairness.

Here’s what a typical treaty does:

Allocates taxing rights between Georgia and the treaty country

Prevents the same income from being taxed twice

Caps withholding tax on dividends, royalties, and interest

Clarifies permanent establishment rules

Requires both countries to share tax information

Which Countries Are Covered?

Georgia’s treaties cover most of Europe, Asia, and parts of the Middle East. Countries include:

United Kingdom

Germany

France

Netherlands

Italy

Turkey

India

China

UAE

Singapore

Israel

Switzerland

These agreements vary in detail. Some eliminate tax completely on certain income types. Others cap the amount that can be taxed by the source country. For example, the treaty between Georgia and Germany allows dividends to be taxed at 5% or 10% instead of 15%.

If you're billing clients in the UK, for instance, the treaty can ensure that only one country taxes the income. Alternatively, the UK may reduce your tax bill by the amount you already paid in Georgia.

Understanding which treaty applies to your situation is key. The difference in tax savings can be significant, especially if your income includes dividends, royalties, or cross-border consulting fees.

The Role of the Multilateral Instrument (MLI)

In 2017, Georgia joined the OECD’s Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting. This agreement, known as the Multilateral Instrument or MLI, upgraded 34 of Georgia’s tax treaties with new global standards.

The MLI matters for several reasons:

It brings anti-abuse clauses into effect. That means countries can deny treaty benefits if arrangements are made solely for tax avoidance.

It updates definitions for permanent establishment to reflect how modern businesses operate, including digital services and remote teams.

It strengthens dispute resolution mechanisms between tax authorities. This is helpful if two countries disagree on who gets to tax your income.

It increases legal certainty. Taxpayers and companies operating across borders know that the treaties are up to date and compliant with OECD standards.

The MLI doesn’t replace existing treaties. It supplements them. Countries can choose which articles to adopt. For founders and remote workers in Georgia, this creates a more predictable tax environment. Especially if your income involves multiple jurisdictions.

For example, if you’re a SaaS founder based in Georgia and your investors are in France, the MLI-aligned treaty ensures fair treatment of cross-border dividends, lowers the chance of double taxation, and protects you from being taxed unfairly just because of your international setup.

That’s a significant advantage for entrepreneurs scaling globally from Georgia.

Tax Credits and Tax Exemptions: The Practical Impact

Let’s say you’re a German resident earning €100,000 from clients in Georgia. Under the treaty, Georgia may tax that income at a low rate. But Germany must either exempt that income or give you a tax credit equal to the tax paid in Georgia.

That means you’re not taxed twice on the same money. Instead, you offset what you’ve already paid. This process depends on proper paperwork, timing, and the country-specific treaty details.

What You Need to Make It Work

To apply a tax treaty, you typically need:

Georgian Tax Residency Certificate

Documentation proving income source

Application or form submitted to your home country’s tax authority

These are not optional. Miss one form, and you could lose access to treaty benefits.

That’s where professional help matters. Firms like Gegidze handle these filings for international clients, ensuring that the structure you use doesn’t just sound good, it works when tax season comes.

How Tax Treaties Affect Dividends, Interest, and Royalties

Many of Georgia’s treaties include reduced or zero rates for:

Dividends

Interest payments

Royalties

That means if your company in Georgia is distributing dividends to a shareholder in France, you may only withhold 5% or less instead of the standard 15%. That’s a huge saving, especially for tech companies paying shareholders or licensing intellectual property abroad.

What if Your Country Has No Double Taxation Treaty with Georgia?

Not every country has a tax treaty with Georgia. While 58 treaties are in force today, including with most EU nations, the UK, the US, India, China, and many others, some countries remain outside that list.

So what happens then?

If your home country has no agreement with Georgia, there are two possible outcomes:

1. You could be taxed twice.

Georgia taxes income that is sourced within its borders. Your home country may tax you on your worldwide income, depending on its own residency rules. Without a treaty, there's no legal obligation for your home country to credit the tax you already paid in Georgia. That means the same income may be subject to both countries' tax rates.

2. Or, you might avoid double taxation through smart structuring.

Even without a treaty, you can reduce or eliminate double taxation risks by carefully managing your tax residency, the source of your income, and where your company is legally based. Some countries allow unilateral relief (foreign tax credits) even without a treaty, though this often requires more paperwork and legal clarity.

In short: no treaty doesn’t mean no hope. But it does mean more caution. If your country isn’t on Georgia’s treaty list, you’ll need even more precise planning to prevent overlap in your global tax obligations.

Understanding Permanent Establishment: How to Avoid Unintentional Tax Triggers

One of the most overlooked risks in cross-border tax planning is the concept of “Permanent Establishment” (PE). It’s a term found in almost every double taxation treaty and in Georgian tax law and it’s a silent tax trap for founders who don’t understand how it works.

In simple terms, a Permanent Establishment is a fixed place of business that gives a foreign country the right to tax you, even if your company is officially registered elsewhere.

Here are the most common ways you might trigger a PE in Georgia:

You hire full-time employees based in Georgia who directly generate revenue

You open an office, warehouse, or co-working space where core business functions happen

You have a sales agent or manager permanently based in Georgia acting on behalf of your company

You sign contracts or negotiate deals regularly from within Georgia

Triggering a PE means your foreign company could suddenly become subject to corporate tax in Georgia, regardless of where it’s registered. Even if you’re based in Estonia, the Netherlands, or the US, if your activities in Georgia meet the PE threshold, Georgian tax authorities may come knocking.

If you’re living and working in Georgia, or if you’ve hired a local team, it’s essential to review whether your business model creates a PE risk. That’s why many founders choose to either fully relocate their business to Georgia or use local hiring solutions like Employer of Record (EOR) services to avoid tax liability at the corporate level.

Real Founder Stories: Solving the Double Tax Puzzle

Let’s break this down with some real-world examples:

Case 1: Tech Startup Founder from Germany

Anna relocated to Tbilisi to take advantage of the 1% tax regime. Her clients were all EU-based, and she registered as an Individual Entrepreneur with Small Business Status. Because Germany has a tax treaty with Georgia, she obtained a Georgian tax residency certificate and provided it to German authorities. The income she paid 1% tax on in Georgia was exempt from further German taxation, thanks to treaty provisions. Total savings? Over €15,000 per year.

Case 2: Marketing Consultant from the US

Brian moved to Batumi but only stayed for 5 months. He earned $80,000 from US clients during that time. Because he didn’t meet Georgia’s 183-day residency rule, he wasn’t eligible for treaty protection. His income was taxed in the US and couldn’t benefit from Georgia’s 1% regime. If he had stayed a few more months and structured correctly, he could have significantly lowered his tax bill.

Case 3: Startup with Team in Georgia, HQ in the UK

A UK-based SaaS company hired three developers in Georgia directly. Without realizing it, they triggered a Permanent Establishment. Their UK accountants advised them to work with an EOR to shift the employment relationship legally, avoiding Georgian corporate tax and retaining their UK tax base. Now, the developers are hired compliantly under a Georgian EOR, and the parent company remains free from unexpected tax obligations.

These aren’t rare situations. They reflect common mistakes and smart fixes that international entrepreneurs face every day.

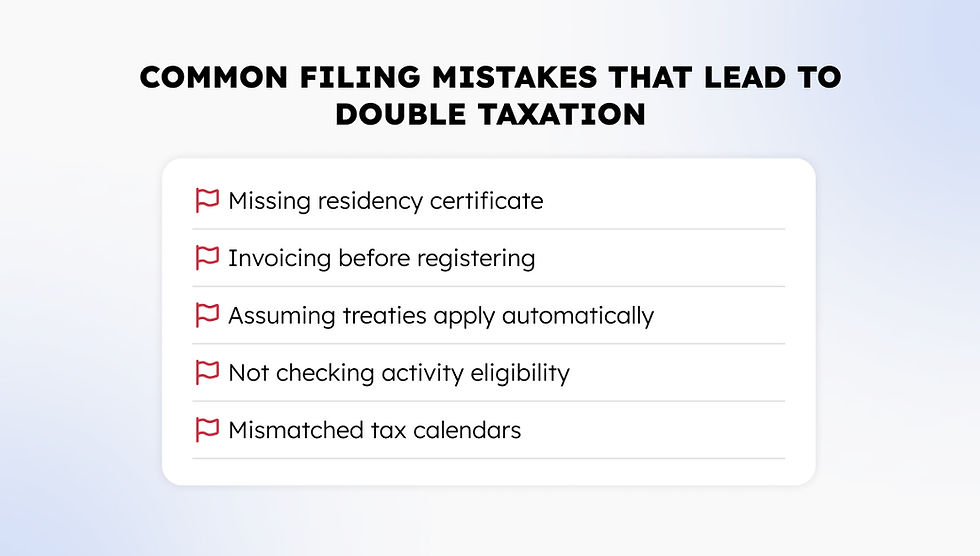

Common Filing Mistakes That Lead to Double Taxation

Even with the best tax treaties in place, you can still fall into traps. Here are the most frequent errors we see:

Missing tax residency certificates

Without official proof from the Georgian Revenue Service, your home country may reject your claim to foreign residency, even if you qualify.

Earning income before registering

If you send invoices before registering your tax status, those early earnings are subject to the full personal income tax rate (20%), not the 1% or tax-exempt treatment you expected.

Assuming treaty benefits apply automatically

They don’t. You must actively apply for them, file declarations, and sometimes get approvals from both countries’ authorities.

Not checking business activity eligibility

Not all income qualifies for low tax rates or treaty benefits. Licensing income, employment wages, or passive income may be treated differently under local law and treaties.

Failing to coordinate with your home country’s tax calendar

Some countries operate on fiscal years that don’t align with Georgia’s tax system, creating timing mismatches and additional scrutiny.

Avoiding these pitfalls is not about luck, it’s about planning and working with experts who know how to align both systems.

How Gegidze Helps You Avoid the Double Tax Minefield

Navigating double taxation rules, treaties, tax residency, and permanent establishment law isn’t something you should have to figure out alone. That’s where Gegidze comes in.

We help founders, freelancers, and international businesses legally move their operations to Georgia, register under the correct tax regimes, and stay 100% compliant. Our team handles:

Tax residency planning

IE registration and Small Business Status setup

Local payroll and EOR services to avoid PE risks

More importantly, we act as your tax translator, connecting what Georgia requires with what your home country expects, so you never fall through the cracks.

If you’re earning across borders, the price of getting it wrong can be steep. But with the right structure, you can enjoy Georgia’s generous tax benefits without surprises. And that’s exactly what we help you do.

If you’re building a global business, freelancing across borders, or just trying to make sense of two tax systems at once, don’t leave it to chance. Gegidze helps founders, remote professionals, and growing teams structure their taxes legally and efficiently in Georgia.

From residency certificates to EOR solutions, we make sure you stay compliant and save money, not get stuck paying twice. Book a free consultation to see what’s possible.

Frequently asked questions (FAQ)

If I pay tax in Georgia, do I still need to pay tax in my home country?

It depends on whether your home country has a Double Taxation Avoidance Agreement with Georgia and whether you meet the tax residency rules. In many cases, you can avoid double taxation through exemptions or tax credits, but you need the proper certificates and filings.

Does Georgia have double taxation treaties with EU countries and the UK?

Yes. Georgia has active tax treaties with most EU countries, including Germany, France, the Netherlands, Italy, and the Baltics, as well as with the United Kingdom. These treaties help reduce or eliminate double tax exposure for EU and UK residents operating in Georgia.

What documents do I need to claim tax treaty benefits in Georgia?

You typically need a Georgian Tax Residency Certificate, proof of income source, and the right forms submitted to your home country’s tax authority. Missing documents may disqualify you from claiming exemptions or credits under a treaty.

How do I know if my income is taxable in Georgia?

Georgia uses a territorial tax system. Only income sourced from within Georgia is taxed. If you're a Georgian tax resident earning income from foreign clients or sources, that income is usually tax-exempt. But salary from a Georgian company or payments from local clients may be taxable.

What is permanent establishment, and how can I avoid it in Georgia?

Permanent establishment (PE) refers to having a fixed business presence in Georgia, like an office or local employees, which can trigger corporate tax obligations. To avoid this, many companies use EOR (Employer of Record) solutions or carefully structure operations with legal guidance.