Georgia's Income, Profit, and Property Taxes: What Every Business Should Know

- Tinatin Tolordava

- May 23, 2025

- 10 min read

Table of contents

Why Georgia’s Tax System Attracts Global Entrepreneurs

Georgia, the country, not the U.S. state, is quietly becoming a magnet for business owners who want lower taxes and fewer bureaucratic headaches.

Its tax code is simple, and its system rewards reinvestment. Compared to Western Europe or North America, the reporting load is refreshingly light. If you're building a company here or considering moving your operations, you’ll want to understand how Georgia income tax, corporate profit tax, and property tax work because that’s where the real savings live.

This Georgia business tax guide breaks down what you pay, how the system is designed, and what structures are available to help you grow smarter.

Georgia’s Simplified Tax Structure: What’s Different?

Let’s start with the big picture.

Unlike most countries that pile on countless indirect fees and hidden rules, Georgia runs on just six core taxes. For businesses, the most relevant ones are:

Personal Income Tax (PIT)

Corporate Profit Tax (CPT)

Value Added Tax (VAT)

Property Tax

Import Tax

Excise Tax

Georgia’s government intentionally created a low-friction tax system to attract foreign investors, digital entrepreneurs, and SMEs. The logic is simple: make it easy, and businesses will come, and they have.

Now let’s look at the details.

How Georgia Income Tax Works for Business Owners

Flat 20% on locally sourced income

For individuals, Georgia income tax is charged at a flat 20% rate. But here’s what makes the system interesting: it only applies to income earned inside Georgia. If you're a digital nomad earning from foreign clients or an entrepreneur paid by a U.S. or EU company, your income might not even be taxable in Georgia.

This territorial tax model means that Georgia doesn’t chase after foreign-source income. It focuses only on what’s generated inside its borders.

Micro Business and Small Business Status

Georgia also offers special tax statuses for solo entrepreneurs and small teams:

Micro Business Status: 0% income tax if your revenue stays under 30,000 GEL (~$10,950) annually. You can’t hire employees, and only certain activities qualify.

Small Business Status (SBS): 1% annual tax on gross turnover up to 500,000 GEL (~$182,500). If you exceed that threshold, the rate jumps to 3% for the excess.

These statuses apply to individual entrepreneurs (IEs), making Georgia an especially appealing place for freelancers, consultants, and startup founders who work remotely.

Georgia Corporate Tax: Profit-Based and Smartly Delayed

Here's where Georgia stands out if you’re operating through a company.

15% Only When You Distribute Profits

Unlike traditional systems, where your company pays tax on all income after expenses, Georgia corporate tax only applies to distributed profits. This system, modeled after Estonia’s, gives founders full control over when their company is taxed.

Reinvest profits into the business? 0% tax

Leave cash sitting in the company bank account? 0% tax

Pay yourself a dividend? 15% corporate tax applies This makes Georgia especially attractive to startups or international businesses that want to grow first and pay tax later.

What Triggers Corporate Tax in Georgia?

Even though you’re only taxed on Georgia profit tax when money leaves the company, there are specific events that trigger it:

Declaring dividends to shareholders

Paying for non-business expenses (for example, a private vacation labeled as a business trip)

Transferring assets without compensation

Overspending on representative or marketing costs Keep your finances clean; you can legally delay taxation while you scale.

If you’re planning to operate through an LLC or distribute dividends, make sure you understand your filing obligations. This step-by-step guide to corporate tax reporting in Georgia breaks it down clearly.

Value Added Tax (VAT) in Georgia: When It Applies

Let’s talk about Georgia VAT, which sits at 18%.

This applies to most goods and services sold inside the country. However, the rules are more flexible than in many European countries.

You Must Register If...

Your annual turnover exceeds 100,000 GEL (around $36,500)

You import goods regularly

You buy foreign digital services (like design tools, ads, or subscriptions) Even if you’re a tech company selling to foreign clients, VAT might still come into play when you import or consume services from abroad.

You Might Be Exempt If...

You only export services (for example, a Georgian-based software firm billing U.S. clients)

You operate under Virtual Zone Status (which we’ll cover shortly)

VAT compliance in Georgia isn’t complicated, but failing to register when required can cause audit trouble. If you're close to the threshold, speak to an advisor before signing that next big contract.

Georgia Property Tax: What Companies and Individuals Pay

Yes, there is a Georgia property tax, and it applies to both physical persons and legal entities. But like everything else in this country’s tax system, it’s designed to be manageable.

For Individuals

If you're an individual who owns real estate in Georgia, your tax rate depends on your household income:

Below 40,000 GEL (~$14,600): Exempt

40,000–100,000 GEL: Taxed at 0.05% to 0.2%

Above 100,000 GEL (~$36,500): Taxed at 0.8% to 1%

The tax is applied to the market value of the property, and you declare it yourself (based on national valuation data). This avoids surprises, especially for expats or remote workers relocating to Tbilisi or Batumi.

For Companies

For legal entities, property tax is based on the average annual residual value of your fixed assets, up to 1%. That includes buildings, vehicles, equipment, and even leased assets in some cases.

If you're building a warehouse, renting office space, or setting up a factory in Georgia, this is a cost to factor in.

Land Tax

Landowners pay land tax in addition to property tax. Rates vary depending on land quality, purpose (agricultural or not), and local municipal rules. Non-agricultural land generally has a base rate of 0.24 GEL per square meter, adjusted by local coefficients.

This is especially relevant for real estate, hospitality, logistics, or manufacturing companies, where land acquisition is part of the core business.

Special Tax Regimes: How to Reduce Your Liability Legally

Now let’s get to the good stuff. Georgia doesn’t just offer fair base rates, it has tax incentives and statuses designed to help businesses optimize their structure.

Virtual Zone Status (VZS)

If you’re running an IT company and serving clients outside Georgia, Virtual Zone Status may eliminate corporate tax altogether.

0% corporate tax on income from foreign clients

No VAT on exported digital services

No need for a local office or team

You must apply for the status through Georgia’s Ministry of Finance. It typically takes less than a month, and most tech startups qualify.

International Company Status (ICS)

If you’ve been operating for 2+ years in permitted industries like software development or support services, you might be eligible for ICS.

5% corporate tax

5% personal income tax on employees

0% property tax (in some zones)

ICS is perfect for scale-ups with payroll, investors, and long-term growth plans. It also boosts your international credibility, especially when opening foreign bank accounts.

Georgia Tax Residency: Why It Matters for Business Owners

If you're operating in Georgia, your tax residency status directly impacts what you pay and where. Georgia tax residency isn’t automatic just because you opened a company or spent a few weekends in Tbilisi. You have to meet clear criteria.

You qualify for Georgia tax residency if:

You spend 183 days or more in Georgia within any 12-month period

You qualify under the High Net Worth Individual (HNWI) program, which requires GEL 3 million in worldwide assets or GEL 200,000 in Georgian-source income for three consecutive years

You apply for and receive a formal tax residency certificate

Why does this matter? Because it allows you to claim Georgia as your base for personal income taxes legally. Your foreign-source income may be fully exempt under Georgia income tax rules if you earn abroad and qualify as a Georgian tax resident.

If you're running a business remotely or managing multiple tax jurisdictions, getting this right can save you money and avoid costly reporting mistakes.

Georgia Business Tax Guide: What You Have to File

Understanding the Georgia business tax guide means knowing what needs to be submitted and when. Even if your company isn’t profitable yet or your profits have yet to be distributed, you have monthly and annual responsibilities.

Here’s what you need to know:

Monthly Obligations

Profit Tax (CIT) is due only when profit is distributed, but companies must still monitor and declare triggering events.

Value Added Tax (VAT): If registered, you must file every month by the 15th of the following month.

Income Tax on Salaries: Salary taxes must be declared and paid monthly if you have employees or contractors paid through your Georgian company.

Reverse VAT: If your company uses foreign services like hosting, ads, or SaaS platforms, you must often declare and pay reverse VAT.

Annual Reporting

Property Tax Declaration: This is due by April 1st each year for legal entities. Individuals must declare by November 1st and pay by November 15th.

Financial Statements: While not always audited, Georgian entities must submit their financial statements annually. The deadline is generally March 31st.

Withholding Tax (if applicable): Depending on DTA treaties, you may be required to withhold and report Georgian tax on foreign-sourced payments such as dividends or royalties.

Filing late? It’s not worth the risk. Fines for missing deadlines or misreporting VAT can escalate quickly. Get a good accountant who understands the Georgian tax system in both Georgian and English (or use a qualified Georgian language translator if needed).

Your business also needs structured bookkeeping to stay compliant with monthly filings and minimize audit risk. Here’s a complete guide on accounting and bookkeeping in Georgia in 2025.

Common Mistakes Foreign Businesses Make in Georgia

Even though Georgia has one of the most business-friendly systems in the region, it’s easy to slip up if you're not prepared. Here are the most common errors entrepreneurs make:

Assuming “tax-free” means no filing: Many remote founders believe they don’t need to file if they owe no tax. However, monthly declarations are still required, even at 0%.

Misunderstanding VAT rules: Using foreign services like Google Ads, Notion, or Zoom? That’s reverse VAT. Miss it, and you risk penalties.

Mixing personal and business expenses: Georgia profit tax rules are strict. If you pay for a family vacation from your company card, that’s a taxable distribution.

Incorrect tax residency assumptions: Spending 3 months in Georgia and calling yourself a tax resident won’t cut it. Residency requires evidence, such as days on the ground or HNWI certification.

Failing to register properly: Whether it’s your Small Business Status, Virtual Zone Status, or correct legal structure, failing to register means missing out on Georgia tax incentives.

Planning to stay for the long haul? Think structure. Get your company aligned from day one.

Georgia Tax Incentives: More Than Just Low Rates

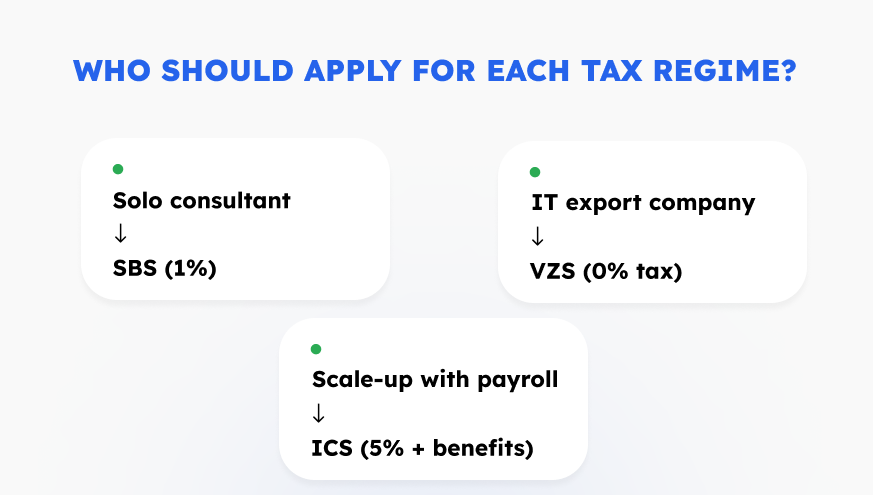

Beyond the simple flat taxes, Georgia offers real advantages for plan founders. Here are the three most commonly used structures to reduce liability:

1. Small Business Status (SBS)

If you're an independent consultant or contractor, SBS offers a 1% tax on turnover up to GEL 500,000. It’s clean, predictable, and scalable, perfect for remote workers or solo founders.

2. Virtual Zone Status (VZS)

This is best for IT companies exporting services abroad. VZS holders enjoy a 0% profit tax on foreign income and full VAT exemptions.

3. International Company Status (ICS)

Built for larger teams and more complex businesses. You get a 5% corporate tax rate, reduced payroll taxes, and access to Georgia tax residency for executives. ICS also boosts your credibility with banks and international partners.

These Georgia tax incentives are legal, government-supported, and fast to apply for, especially compared to Western Europe, where structures like these are rare or slow.

Choosing the Right Business Structure

Before applying for a tax status or license, you must choose the right entity. Most foreign entrepreneurs choose one of the following:

Individual Entrepreneur (IE): Fastest and cheapest to set up. Ideal for freelancers or solo consultants under SBS.

Limited Liability Company (LLC): Offers full separation between personal and business finances. Ideal for teams, long-term operations, or scaling.

Branch Office or Representative Office: These are less common but useful if you already have a foreign company and want a local presence.

Each structure comes with different tax exposure. For example, an LLC allows you to use Georgia corporate tax deferral. An IE gives you 1% tax but exposes you personally to business debts.

Choosing wrong not only costs more in taxes but can also harm compliance, investor relationships, and local reputation. Structure matters.

Why Georgia's Tax Environment Favors Long-Term Planning

The final reason entrepreneurs choose Georgia? It rewards forward thinking.

The Estonian model used in Georgia means that you can scale without tax drag. You can delay paying corporate tax until your company is stable or profitable. With the country’s straightforward reporting system and generous exemptions, Georgia is a smart choice for growth-stage founders.

You don’t need tricks, shell companies, or crypto loopholes. Georgia’s system is already better than that of most other countries.

And if your accountant knows how to plan around Georgia property tax, deferred dividends, and VAT rules, your effective tax rate could be near zero for years.

Final Word: Is Georgia the Right Fit for Your Business?

Georgia checks every box if you want to legally reduce your tax bill, reinvest profits without penalties, and operate in a business-friendly country with clear rules.

Here’s a quick recap of what makes it work:

15% Georgia corporate tax only on distributed profits

1% Georgia income tax under Small Business Status

Flexible, transparent Georgia property tax rules

Legal Georgia tax incentives with fast approval

No taxation on foreign-source income if structured right

Clean pathways to tax residency for founders and professionals

This Georgia business tax guide doesn’t replace professional advice but gives you the framework to move smartly, reduce liability, and grow confidently.

Want help setting up your structure or registering tax status in Georgia?

Gegidze works with global entrepreneurs to launch, manage, and scale companies across Georgia.

Schedule a free call and get expert support.

Frequently asked questions (FAQ)

What is the corporate tax rate in Georgia for businesses?

Georgia corporate tax is 15% and only applies to distributed profits. If you reinvest earnings and don’t pay dividends, your company pays 0%.

Do small businesses qualify for lower tax rates in Georgia?

Yes. Under Small Business Status, registered entrepreneurs can pay just 1% on turnover up to 500,000 GEL. It’s one of the lowest effective business taxes globally.

How is Georgia's property tax calculated for businesses and individuals?

Legal entities pay up to 1% of their fixed assets' average annual residual value. Individuals pay between 0% and 1%, depending on income and property value.

What tax incentives exist for foreign-owned businesses in Georgia?

Georgia offers several business-friendly regimes, including Virtual Zone Status for IT companies and International Company Status with reduced tax rates and exemptions.

When do I need to file taxes in Georgia as a business owner?

Most taxes, like VAT and profit tax, are filed monthly. Property tax and financial statements are filed annually. This Georgia business tax guide breaks down all the key deadlines.