Crypto Payroll in Georgia: How Foreign Companies Can Pay Teams Legally

- Tinatin Tolordava

- Nov 24, 2025

- 10 min read

Table of contents

Why Foreign Companies Look to Georgia

Paying global teams in crypto sounds simple. In reality, it creates legal and tax risks.

In the EU and US, direct salaries in Bitcoin or Ethereum are either unregulated or hit with heavy payroll taxes.

Georgia has taken the opposite approach.

Here, crypto is legal, conversions are VAT-free, and payroll tax rates are some of the lowest in the world. Employees can be taxed at just 5%, contractors at 1%.

For foreign companies running Web3 crypto payroll, managing DAO payouts, or paying iGaming staff, Georgia offers clarity. And with Gegidze crypto services, payroll becomes a streamlined global payroll solution.

Is Crypto Payroll Legal in Georgia?

Yes, but only when structured correctly.

Crypto in Georgia is not legal tender. Salaries and contracts must be denominated in Georgian Lari (GEL).

That means you can’t just send Bitcoin straight to an employee’s wallet. The Revenue Service won’t treat it as a legal salary.

Instead, companies fund payroll in crypto, and it’s converted into GEL before payout. This satisfies both labor law and tax compliance.

With Gegidze, the model is simple:

Send Bitcoin, ETH, or stablecoins

Crypto converted at 1.2–1.5% exchange rate

Employees receive GEL salaries taxed at 5%

Contractors receive GEL income taxed at 1%

This process makes crypto payroll in Georgia fully legal.

Why Georgia Works for Crypto Payroll

Georgia has positioned itself as a hub for foreign companies.

Tax advantages:

Crypto tax in Georgia: Individuals trading crypto on foreign exchanges pay 0% capital gains tax

Corporate tax in Georgia: Only paid when profits are distributed, not reinvested

No VAT on crypto-to-fiat conversions

Business setup:

LLC setup in Georgia in 1–2 days

Georgia bank account opened remotely in 3–5 days

Easy access to Georgia visas for employees with compliant payroll

For companies paying remote developers, contributors, or freelancers, this structure beats anything offered in Europe or the US.

Two Payroll Models: Employees vs Contractors

When it comes to crypto payroll in Georgia, foreign companies have two ways to classify workers. The choice matters because each path comes with distinct tax benefits, compliance requirements, and advantages for global teams.

Employees with EOR Georgia

One option is to hire staff as employees through Employer of Record (EOR) Georgia.

With Gegidze acting as the legal employer, the entire payroll process stays compliant under Georgian law.

Here’s what that looks like:

Payroll filed directly with the Revenue Service → every salary reported and taxed properly.

Employment contracts compliant with labor law → workers receive legally binding contracts recognized in Georgia.

Employees pay only 5% income tax → far lower than the standard 20% in most countries.

Access to benefits and recognition → employees gain official records that support applications for Georgia visas, mortgages, and bank loans.

This structure is ideal for companies that want stable long-term teams. It works especially well for Web3 startups building permanent dev teams, foreign firms setting up local hubs, or iGaming companies running regulated operations.

By running payroll under EOR Georgia, businesses enjoy credibility, employees get security, and the company avoids penalties for non-compliance.

Contractors with Individual Entrepreneur (IE) Status

The second option is to classify team members as contractors and register them as Individual Entrepreneurs (IEs).

Once approved for Small Business Status, the tax benefits are unbeatable:

Flat 1% turnover tax on income up to GEL 500,000 per year.

Contractors handle their own tax filings, simplified by Gegidze’s registration support.

Perfect for DAO payouts in Georgia, where global contributors need a legal way to receive income.

Attractive for Web3 developers and freelancers who prefer flexible contracts.

Commonly used in iGaming payroll for remote staff who work project-by-project.

This model maximizes take-home pay while keeping everything legal. Instead of paying high freelance taxes abroad, contractors in Georgia can structure their income at just 1%.

Foreign companies like it because it lowers payroll costs without losing compliance. Contractors love it because they keep more of what they earn.

Which Model Should You Use?

The decision comes down to your workforce.

Choose EOR Georgia if you need full-time staff, stable payroll, and legal employment records for visa applications or long-term relocation.

Choose IE with Small Business Status if your team is freelance-heavy, project-based, or structured as a DAO.

The good news: Gegidze manages both. Foreign companies can mix employees and contractors, pay everyone in crypto, and stay compliant with Georgian law.

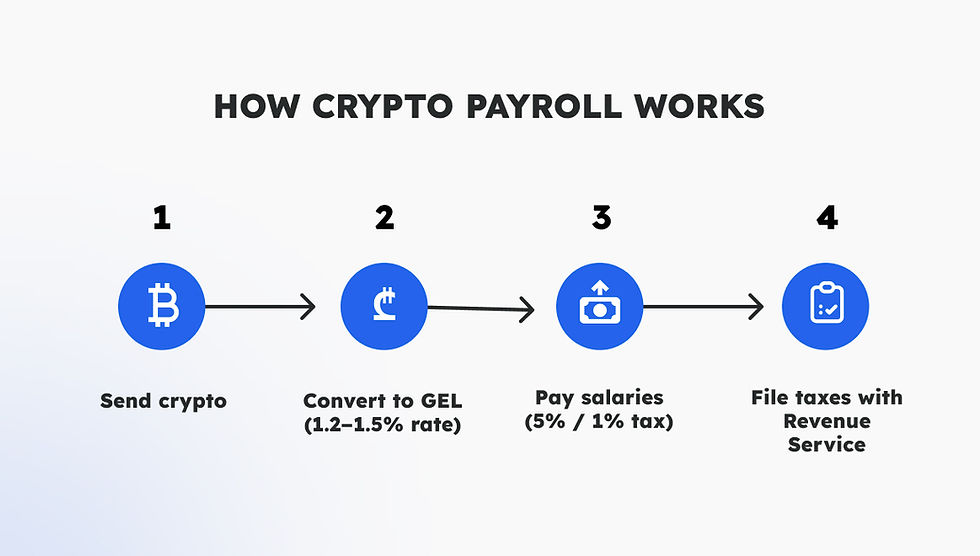

How Crypto Payroll Works with Gegidze

Step 1 – Company sends crypto

Payroll funded in Bitcoin, Ethereum, or stablecoins.

Step 2 – Crypto converted

Exchanged into GEL, USD, or EUR at a transparent 1.2–1.5% rate.

Step 3 – Salaries paid

Employees taxed at 5%. Contractors taxed at 1%. Payments land directly in local bank accounts.

Step 4 – Taxes filed

Declarations submitted to the Georgian Revenue Service. Compliance done automatically.

This model removes the need for crypto licenses in Georgia or direct VASP registration.

Beyond Payroll: Special Tax Regimes for Crypto Companies in Georgia

Georgia is already attractive for crypto payroll, but the benefits don’t stop there.

The government has created special regimes that make corporate structures even more efficient for Web3 startups, DAOs, iGaming platforms, and crypto mining companies.

These statuses reduce taxes close to zero while keeping operations fully legal.

Virtual Zone Crypto Georgia

The Virtual Zone status was designed to attract IT and blockchain companies. It’s the go-to option for firms exporting services abroad.

Key benefits:

0% corporate tax on foreign-sourced IT and blockchain revenue

No VAT on exported services

Applies to businesses building dApps, smart contracts, or blockchain infrastructure for international clients

Best for:

Web3 payroll structures, software development companies, and blockchain firms serving global markets. Instead of paying high rates abroad, foreign companies enjoy a tax-free corporate base in Georgia.

International Company Georgia

The International Company status is tailored for larger, established firms that need a recognized presence in Georgia. It offers reduced corporate and personal taxes, making payroll even cheaper.

Key benefits:

0% dividend tax for shareholders

5% personal income tax on salaries paid to employees

Best for:

Crypto exchanges, Web3 platforms with local offices, or iGaming companies that need substance in Georgia for global compliance. The IC status balances low taxes with international credibility.

Free Industrial Zone Mining Georgia

For crypto mining in Georgia, the Free Industrial Zones (FIZs) are unmatched. Located in cities like Kutaisi, Poti, and Tbilisi, these zones create a near tax-free environment for mining operations.

Key benefits:

0% corporate tax on profits

0% VAT on goods and services outside Georgia

No import duties on mining rigs, cooling equipment, or hardware

Access to competitive electricity rates

Best for:Large-scale Bitcoin mining farms, Ethereum validators, or any crypto infrastructure project needing equipment imports. A FIZ can reduce effective tax to almost zero.

Industry Examples

Web3 crypto payroll Georgia

Startups can raise capital in ETH or stablecoins and pay developers worldwide with 1% or 5% tax.

DAO payouts Georgia

DAOs send USDT to Gegidze, and contributors get GEL salaries with contracts and tax recognition.

iGaming crypto Georgia

Platforms serving foreign players can avoid VAT on revenue and pay staff locally through compliant payroll.

Free Industrial Zone mining Georgia

Mining farms operate tax-free, import rigs duty-free, and manage payroll legally through Gegidze.

Georgia vs EU vs US: Payroll Reality Check

Why are companies routing payroll through Georgia? The numbers speak for themselves.

1. The EU Reality

Up to 40% payroll tax in countries like France or Germany.

Incorporation = months of waiting + €€€ legal fees.

One founder told us: “By the time we finished paperwork in Berlin, our competitors were already hiring in Tbilisi.”

2. The US Maze

50 states, 50 rules. Payroll and compliance change by location.

SEC + money transmitter licenses = heavy oversight.

Average startup payroll cost = 30–35% on top of gross salaries.

A fintech client called it: “Death by reporting forms.”

3. Georgia’s Shortcut

Crypto payroll structured at 1% or 5%.

LLC setup: 1–2 business days.

Bank account: 3–5 days, remote.

Corporate tax? Deferred until profit distribution.

“We registered on Monday, onboarded staff by Friday.” — client in SaaS.

Quick Comparison Table

Region | Payroll Taxes | Incorporation | Crypto Rules | Banking |

EU | Up to 40% | Slow, costly | VAT may apply | Rigid |

US | 30–35% + reporting | Patchwork by state | SEC scrutiny, licenses | Strict |

Georgia | 1%–5% | 1–2 days | Legal, no cap gains (for individuals abroad) | Remote, 3–5 days |

The Takeaway

For companies running global payroll, Georgia is the outlier — lighter, faster, cheaper.

Industry-Specific Tax Planning

Not every crypto business is the same. Georgia offers flexible tax regimes depending on industry.

Web3 and Blockchain Development

Qualify for Virtual Zone status

0% corporate tax on foreign-sourced revenue

No VAT on exported services

Perfect for startups building dApps, smart contracts, and Web3 infrastructure

Exchanges and Platforms

Apply for International Company status

5% corporate tax, 0% dividend tax, 5% salary tax

Recognition under Georgian law, improving banking relationships

Mining Operations

Base operations in Free Industrial Zones

0% corporate tax, 0% VAT, no import duties on mining rigs and equipment

Competitive power costs

Combine with Gegidze payroll services for compliant staff payments

iGaming Companies

Revenue from foreign players classified as export of services → 0% VAT

Payroll streamlined through Gegidze without touching VASP licensing

Ideal for online casinos, sportsbooks, and betting platforms

DAOs

No need to incorporate as a traditional company

Treasury payouts structured as contractor payments

Contributors pay just 1% tax under IE Small Business Status

Common Mistakes Foreign Companies Make in Georgia

Georgia makes crypto payroll easy, but that doesn’t mean companies can cut corners. Even in a crypto-friendly country, mistakes cost money.

Paying Salaries Directly in Bitcoin

Many foreign founders think they can send Bitcoin or Ethereum straight to a worker’s wallet and call it payroll. Wrong.

Under Georgian law, salaries must be settled in Georgian Lari (GEL) to be recognized by the Revenue Service. Direct crypto transfers are not treated as legal salaries. That means no tax filing, no employment recognition, and potential penalties.

With Gegidze crypto payroll Georgia, crypto is converted into GEL at a low 1.2–1.5% exchange rate, salaries are paid legally, and taxes are filed correctly.

Assuming LLC Setup = Automatic Tax Perks

Setting up an LLC in Georgia is fast, but it does not unlock Virtual Zone or International Company benefits automatically.

Virtual Zone crypto Georgia requires an application proving you export IT or blockchain services.

International Company Georgia demands substance, like a local office and employees.

If you assume benefits apply automatically, you risk paying the full corporate tax in Georgia (15%) instead of the reduced rates.

Ignoring AML/KYC Rules

Georgia is friendly to crypto, but banks still require AML (Anti-Money Laundering) and KYC (Know Your Customer)checks.

Large crypto-to-fiat conversions without proper documentation can be blocked by banks. Missing contracts, invoices, or IDs create delays and red flags.

Gegidze crypto services handle AML and KYC before the transfer happens, ensuring smooth payroll processing.

Misclassifying Employees as Contractors

Worker classification matters. Employees and contractors are taxed differently.

Employees under EOR Georgia pay just 5% income tax.

Contractors registered as Individual Entrepreneurs with Small Business Status pay 1% turnover tax.

But misclassify them, and the Revenue Service can reclassify workers, charge back taxes, and add penalties.

Gegidze prevents this by structuring payroll correctly from the start. Workers are classified properly, taxes are optimized, and compliance is guaranteed.

Every one of these mistakes is avoidable. Gegidze structures payroll correctly from day one, converts crypto to fiat legally, applies for tax incentives, and ensures AML/KYC compliance.

Foreign companies avoid fines, workers get paid on time, and the business stays fully compliant while enjoying Georgia’s unique tax benefits.

Why Georgia Beats Other Crypto Payroll Jurisdictions

What makes Georgia stand out compared to Estonia, Portugal, or Dubai?

Lower payroll taxes: 1% and 5% vs 20–40% in Europe

No VAT on conversions: keeps crypto payouts efficient

Estonian tax model: 0% corporate tax until profits are distributed

Faster setup: Incorporation in days, not weeks

Remote banking: Georgia bank accounts set up without physical visits

Immigration pathway: Payroll records support Georgia visa applications

This balance of compliance and tax efficiency has made Georgia the crypto payroll capital of the Caucasus region.

Why Gegidze Is the Shortcut

Crypto payroll looks simple but gets complicated fast. Banks demand paperwork. Employees want compliant contracts. Contractors need tax IDs. Regulators want reports.

Gegidze solves all of this in one system.

Employer of Record Georgia: Employees onboarded with contracts, taxed at 5%

Individual Entrepreneur setup: Contractors registered with Small Business Status, taxed at 1%

Crypto-to-fiat conversion: Done at just 1.2–1.5% exchange rate

Compliance: AML, KYC, and payroll filings done automatically

Global reach: Perfect for Web3 teams, DAOs, iGaming operators, and mining firms

Foreign companies get the tax perks of Georgia without needing a crypto license in Georgia or VASP registration.

Georgia has become the smartest choice for crypto payroll: legal, low-tax, and fast.

Instead of struggling with compliance in Europe or the US, foreign companies can pay global teams through Gegidze, legally, tax-efficiently, and with less overhead.

Book a consultation today. Discover how to structure crypto payroll in Georgia so your team pays less tax, your company stays compliant, and your business scales without friction.

Frequently asked questions (FAQ)

Is crypto payroll legal in Georgia?

Yes. Crypto in Georgia is legal, but salaries must be settled in Georgian Lari (GEL) to be recognized by the Revenue Service. Companies can still fund payroll in Bitcoin or Ethereum, but it must be converted before payout. Through Gegidze crypto payroll Georgia, salaries are paid legally with full tax compliance.

What is the tax rate for employees and contractors?

Employees hired under EOR Georgia pay just 5% income tax. Contractors registered as Individual Entrepreneurs with Small Business Status pay 1% turnover tax up to GELDo foreign companies need a crypto license in Georgia? 500,000. This makes paying employees in crypto in Georgia one of the most tax-efficient options worldwide.

Do foreign companies need a crypto license in Georgia?

No, not for payroll. Crypto licenses in Georgia (VASP registration) are required only for exchanges, custodial wallets, or platforms holding client funds. Using Gegidze’s crypto payroll services avoids licensing requirements while keeping operations compliant.

What are the corporate tax benefits for crypto companies in Georgia?

Virtual Zone crypto Georgia: 0% corporate tax on foreign-sourced IT and blockchain revenue.

International Company Georgia: 5% corporate tax, 0% dividend tax, 5% payroll tax.

Free Industrial Zone mining Georgia: 0% corporate tax, 0% VAT, no import duties on mining rigs.

These regimes make crypto payroll in Georgia and corporate structuring highly tax-efficient.

Can Web3 startups and DAOs use crypto payroll in Georgia?

Yes. Web3 crypto payroll Georgia and DAO payouts Georgia are structured through Gegidze. Contributors can be paid as employees at 5% or as contractors at 1%, with crypto converted to GEL legally. This ensures payouts are tax-recognized and compliant.