Tax Haven Your Competitors Don’t Want You to Know About: How to Optimise Taxes for Influencers

- Tinatin Tolordava

- Aug 26, 2025

- 11 min read

Table of contents:

Why Influencers Lose Money to Taxes

You’ve built an audience.

Brands pay for your reach. YouTube, TikTok, or Instagram wires in thousands every month.

Then comes tax season. Suddenly, your hard-earned money evaporates.

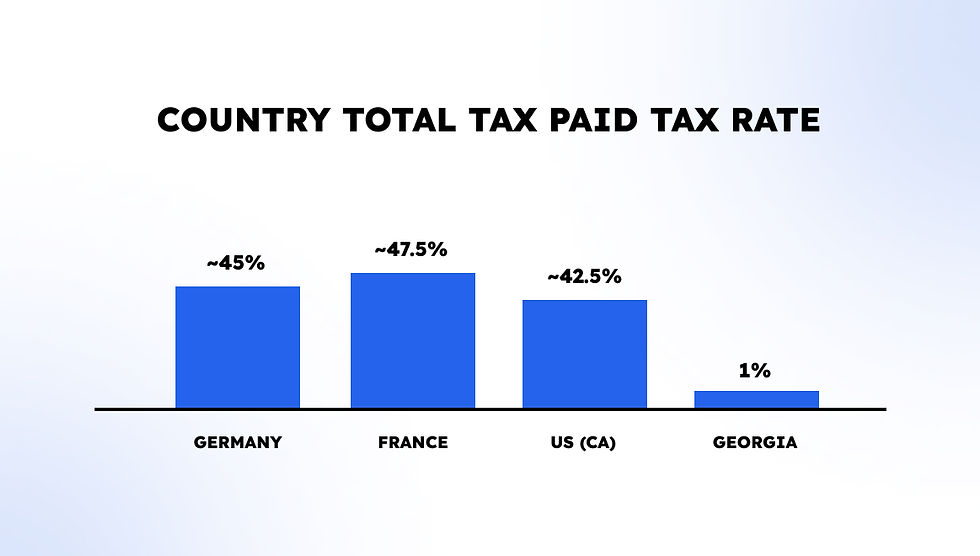

In Germany, self-employed influencers can pay up to 42% income tax plus social contributions. In France, creators may see nearly half of their brand deal revenue swallowed by the state. In the US, federal tax plus state tax often adds up to over 35%.

That means if you make €200,000, you might only keep €100,000. The other half funds someone else’s budget.

This is where your competitors are playing smarter. Some of them are already moving their businesses to Georgia, a country with one of the simplest and most attractive tax systems for freelancers, influencers, and digital entrepreneurs.

And they probably don’t want you to know about it.

Why Georgia Is Different

Georgia doesn’t just compete with Europe or the US. It competes with global “tax havens.” But here’s the catch: unlike shady offshore islands, Georgia offers full transparency, legal recognition, and credibility.

The Georgian tax code is designed to attract entrepreneurs and creators. The system is simple:

0% corporate income tax and 0% VAT for IT and SaaS firms under the Virtual Zone regime.

Only 5% dividend tax when you take money out of your company.

No wealth tax, no inheritance tax, no net worth tax.

And there’s more.

The cost of living in Georgia is low. Apartments in Tbilisi Georgia or Batumi cost a fraction of Berlin or New York. Buying real estate in Tbilisi Georgia, whether apartments for sale in Tbilisi Georgia or land for sale in Batumi Georgia, is still affordable. For influencers, this means you can cut expenses while also investing in property that could help with residency by investment.

Daily life is easy to manage. Opening a bank account in Georgia is straightforward. Banks like Bank of Georgia, TBC Bank, and Liberty Bank Georgia all provide modern online banking. To comply, you’ll need certified translations (English to Georgian translation, Georgian language translator services), which Gegidze handles for you.

How Influencer Income Is Usually Taxed

Before we dive deeper into Georgia’s benefits, let’s see why influencers face such heavy tax burdens elsewhere.

Most countries treat influencer income as self-employed revenue. That includes:

Sponsorships and brand deals.

YouTube AdSense revenue.

Affiliate commissions.

E-commerce sales from merch or digital products.

Paid subscriptions (Patreon, OnlyFans, Substack).

In Germany, that means income tax plus trade tax plus social contributions. In France, you’ll pay progressive income tax and mandatory pension contributions. In the US, it’s federal income tax plus self-employment tax and state income tax.

So when influencers compare, Georgia looks like a breath of fresh air.

Example: €200,000 influencer income

In Germany: around €90,000 goes to taxes and social contributions.

In France: around €95,000 gone.

In the US (California): around €85,000 gone.

In Georgia: if you register as an Individual Entrepreneur with small business status, you pay just 1% tax, €2,000.

That’s not a typo. €2,000 instead of €90,000.

Even if you scale higher and move to a Virtual Zone LLC with 0% corporate income tax, your liability is still minimal.

Georgian Tax Options for Influencers

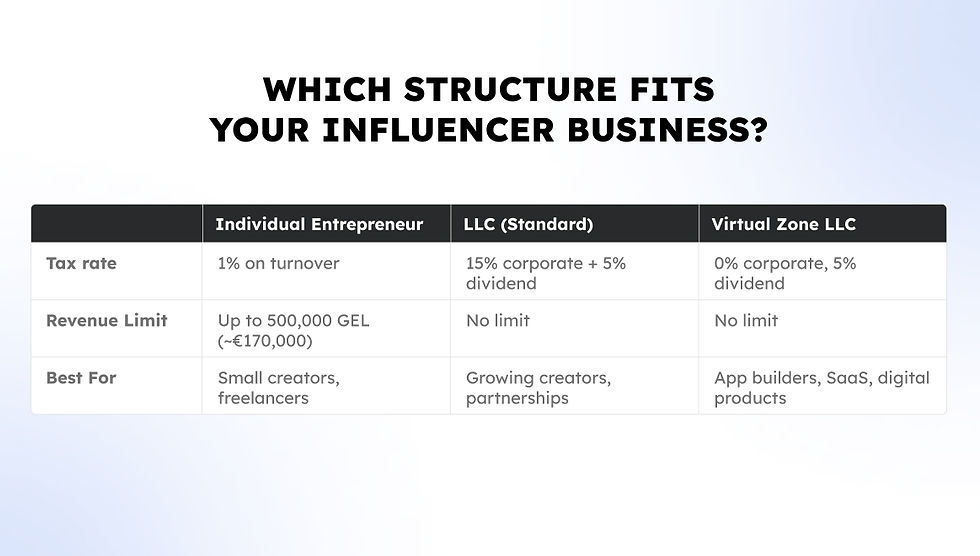

Influencers aren’t all the same. A TikToker with €50,000 annual sponsorships doesn’t need the same structure as a YouTuber making €2 million in AdSense. Georgia’s system is flexible enough to cover both ends.

This is the most popular choice for influencers starting out.

Pay just 1% tax on turnover up to 500,000 GEL per year (~€170,000).

Simple registration with the Revenue Service Georgia.

Monthly tax filing, but easy to manage.

Perfect for one-person businesses doing brand deals, coaching sessions, and digital product sales.

Think of an Instagram creator making €80,000 per year in sponsorships. Under the IE regime, tax is just €800. Compare that to €30,000+ in Europe. That’s why so many creators move to Georgia.

LLC with Virtual Zone Status

Not every influencer only posts selfies or videos. Many build apps, SaaS tools, or digital platforms around their personal brand. If your business crosses into tech, the Virtual Zone is unbeatable.

0% corporate income tax on foreign income.

0% VAT on services exported abroad.

5% dividend tax only when you distribute profits.

For example, a fitness influencer who creates a subscription-based fitness app can register a Georgian LLC with Virtual Zone status. If the app earns €500,000 in the US and EU, there is no corporate tax in Georgia. The founder only pays €25,000 (5%) when they distribute dividends.

This is cleaner and cheaper than almost any structure in Europe or the US.

Georgian Tax Residency

Optimising company taxes is one step. Optimising personal taxes is another.

If you stay a tax resident in Germany while running a Georgian company, Germany may still try to tax your dividends. That’s why many influencers also apply for Georgian tax residency.

There are two main ways:

Spend 183 days per year in Georgia.

Qualify under the High Net Worth program, which requires proof of income and assets.

Once you are a Georgian tax resident, dividends are taxed at just 5%. There are no wealth taxes, no extra levies, no inheritance tax. Compare that to 25% in the UK, 27% in Spain, or 30% in France.

For influencers, that’s a game-changer.

Real Estate and Lifestyle Perks for Influencers

Taxes are important, but lifestyle also matters. Georgia scores high here too.

Apartments in Georgia are affordable compared to other influencer hubs. A luxury apartment in Tbilisi might cost €150,000, while the same in Paris would be €1 million.

Many influencers buy apartments in Batumi Georgia as investment properties or even to qualify for residency by investment.

Rent is equally attractive. A modern apartment for rent in Tbilisi Georgia might be €600–800 per month. Compare that with €2,500 in London or New York.

Food, transport, and services are cheap, and the influencer scene is growing. Cafes in Tbilisi are filled with creators editing videos, developers coding apps, and expats building online businesses. It’s an easy place to connect and collaborate.

For influencers, that means more money stays in your pocket, both through tax savings and through daily expenses.

One of the biggest concerns for influencers moving abroad is banking. Georgia is prepared for that too.

Major banks like Bank of Georgia, TBC Bank, and Liberty Bank Georgia provide modern online systems, debit and credit cards, and easy international transfers.

To open a business account, you’ll need:

Company registration papers.

Passport copy.

Certified translations (translation English Georgian, English to Georgian translator).

Invoices to foreign brands look professional coming from a Georgian LLC. Unlike offshore entities, Georgia’s credibility helps influencers sign contracts without raising eyebrows.

Compliance is simple.

Even if you owe no taxes, you file monthly reports with the Revenue Service Georgia.

Gegidze helps influencers keep this clean so that income from YouTube, Instagram, or TikTok never creates legal headaches.

Why Georgia Beats Other “Tax Havens”

Many influencers look to Dubai, Cyprus, or Malta to cut taxes. But Georgia often beats them.

Dubai has no personal income tax, but the cost of living is high, and influencers face new corporate tax rules.

Cyprus offers tax breaks but requires significant physical presence and higher setup costs.

Malta has low effective rates but involves complex structures and high compliance.

Georgia keeps it simple.

Transparent.

Low-cost setup.

Easy translations and compliance.

Recognised by global banks and supported by double tax treaties.

That combination is rare. It’s why more influencers are quietly moving here, even if they’re not posting about it publicly.

Case Scenarios for Influencers

Not all influencers make money in the same way. Some depend on brand deals, others rely on subscriptions, and others create full-scale businesses around their personal brand. Georgia’s system adapts to all of these.

YouTubers with AdSense Revenue

YouTube creators often have a clear revenue stream: monthly AdSense payments from Google. In most countries, this is taxed as self-employed income. For a creator earning €120,000 annually, that could mean €40,000–50,000 lost to taxes.

With Georgian Individual Entrepreneur small business status, that same income faces just 1% turnover tax — about €1,200 per year. The difference is staggering.

On top of that, opening a Bank of Georgia or TBC Bank account makes it easy to receive international payments without complications. Add a Georgian language translator to prepare your documents, and the setup is smooth.

Instagram and TikTok Influencers Doing Brand Deals

Instagram and TikTok stars rely heavily on brand partnerships. A typical deal involves invoicing a fashion, beauty, or lifestyle brand in Europe or the US.

If those invoices are issued from a Georgian LLC, especially one with Virtual Zone status, the tax burden drops dramatically:

0% corporate income tax.

0% VAT on the exported service.

5% only when dividends are distributed.

This structure makes influencers far more competitive. Brands are happier to work with creators who can send clean invoices from a properly registered company rather than struggling with freelancers juggling personal bank accounts.

Online Coaches and Digital Course Creators

More influencers are launching courses, workshops, and digital coaching. A fitness influencer might sell programs online, while a business coach might charge for group sessions.

Georgia is perfect for this model. These services are exported to international clients, so they qualify for Virtual Zone benefits or 1% IE taxation, depending on scale.

Selling €80,000 worth of online programs from Paris could mean €30,000 in taxes. From Tbilisi, it could mean €800.

Business Registration vs Tax Residency

Here’s where many creators get confused: having a Georgian company is not the same as being a Georgian tax resident.

Registering a Company in Georgia

You can form an LLC in Georgia without living there. It’s quick, often just a few days with translated documents. Many influencers do this first because it allows them to invoice brands and receive payments legally with almost no corporate tax.

Becoming a Georgian Tax Resident

Tax residency applies to you as a person. If you stay in Georgia for 183 days in a year, you automatically qualify. High earners can also apply through the High Net Worth program, even if they spend less time in the country.

Why does it matter? Because while your company might be taxed at 0%, your home country might still tax your dividends if you remain a tax resident there. Becoming a Georgian tax resident solves this problem. Dividends are taxed at just 5% in Georgia, and double taxation treaties help avoid paying twice.

The Smart Combination

The most efficient setup for influencers is often:

A Georgian LLC with Virtual Zone or IE registration for the business.

Georgian tax residency for the person.

This way, you control both sides of the equation: your business income and your personal income.

Lifestyle: Why Influencers Thrive in Georgia

Moving to Georgia is never just about the taxes. It’s about building a life that feels good day to day. The country offers more than favourable tax rules, it gives you modern housing, affordable living, and a creative atmosphere that attracts people from all over the world.

Housing Options

Apartments in Tbilisi Georgia are stylish, well-built, and still surprisingly affordable compared to London, Berlin, or New York.

Even luxury apartments with panoramic views cost less than half of what you’d pay in Western Europe.

Many entrepreneurs and influencers choose to buy apartments for sale in Tbilisi Georgia or invest in apartments in Batumi Georgia, where prices are lower and the seaside lifestyle adds extra appeal.

Others look for land for sale in Georgia to build villas or secure long-term investments.

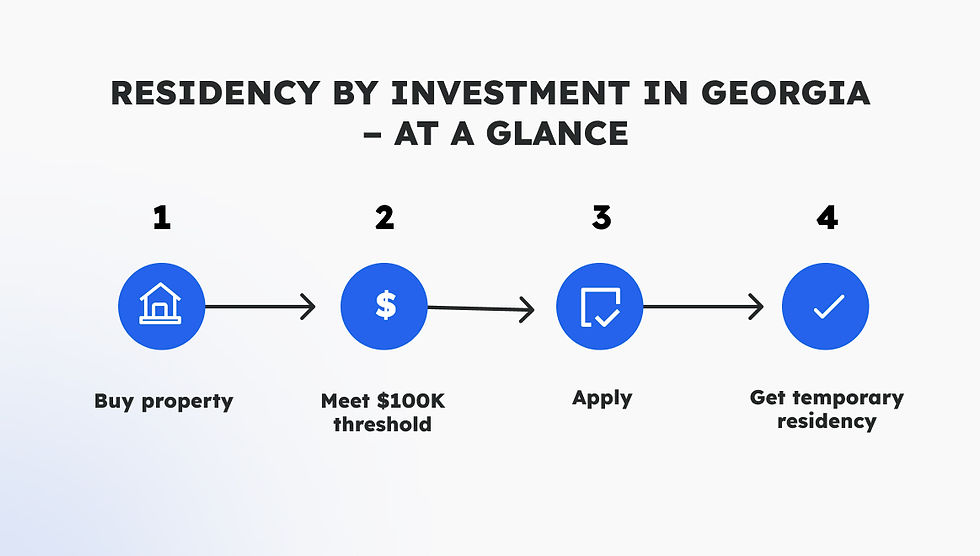

Residency by Investment

Real estate is not just a smart financial move, it’s also a way into the country. Buying property worth around $100,000 can qualify you for temporary residency in Georgia.

For digital nomads, freelancers, and business owners, this is an easy path to stability without the high costs or red tape of European residency programs.

Cost of Living Advantages

The average cost of rent in Georgia is low compared to major cities worldwide.

A fully furnished apartment for rent in Tbilisi Georgia might be €600–800 per month, while the same in New York, Paris, or London can reach €3,000+.

Utilities, internet, transport, and food are equally affordable. Even taxis and everyday groceries cost a fraction of what you’re used to in Europe or the US.

This means your income stretches further, letting you save more or reinvest into your projects.

Creative and Business Community

Georgia has become one of the most exciting hubs for creators, freelancers, and entrepreneurs.

In Tbilisi, you’ll find buzzing coworking spaces, cafes full of startup founders, and a growing network of international professionals.

Whether you’re running a YouTube channel, managing an IT agency, or looking to expand a SaaS company, the connections are here.

It’s common to see people editing videos, launching online stores, or planning marketing campaigns from the same coffee shop.

Balance of Lifestyle and Business

When you combine affordable real estate in Georgia, tax advantages, and a vibrant expat scene, you get more than a “tax haven.”

You get a country where your work-life balance actually improves.

The savings on corporate tax in Georgia, the low property tax, and the chance to live in modern apartments in Tbilisi Georgia or by the Black Sea in Batumi Georgia make it a long-term lifestyle choice, not just a financial one.

Why Georgia Beats Other Popular Relocation Choices

Influencers often compare Georgia with Dubai, Cyprus, or even Bali. Let’s break it down.

Dubai: Attractive tax-free status, but new corporate tax rules complicate things. Cost of living is very high.

Cyprus: Offers tax advantages but comes with higher corporate compliance and more bureaucracy.

Bali (Indonesia): Cheap lifestyle, but tax compliance is confusing and less secure.

Georgia:

1% IE tax up to 500,000 GEL.

0% corporate tax for Virtual Zone companies.

5% dividend tax for residents.

Low setup costs.

Recognised and credible banking.

For influencers who want both low taxes and a real base to build credibility, Georgia consistently comes out on top.

Why Entrepreneurs Choose Gegidze

Georgia’s tax system is powerful, but the paperwork can be confusing if you’re new to it. Registration, translations, compliance, and banking all come with their own rules. That’s where Gegidze makes a difference.

We support businesses and entrepreneurs at every stage:

Registering an LLC or Individual Entrepreneur.

Applying for Virtual Zone status with the Ministry of Finance.

Opening business accounts with leading banks like Bank of Georgia and TBC Bank.

Providing accurate English to Georgian translations for legal and tax documents.

Handling payroll, contracts, and employee management.

Managing monthly filings with the Revenue Service Georgia.

Advising on Georgian tax residency to protect personal income.

Instead of getting lost in regulations, you focus on growing your business. We make sure your setup in Georgia stays compliant, efficient, and ready for long-term growth.

No matter if you’re an influencer, a freelancer, or running a fast-growing agency, Georgia gives you options that very few countries can match.

From the 1% Individual Entrepreneur regime to Virtual Zone companies with 0% corporate tax, the structures here are simple, powerful, and built for international income.

The real advantage isn’t just low taxes. It’s the ability to work globally with a clean, compliant setup that doesn’t scare off partners, clients, or banks.

Georgia lets you keep more of your money, reinvest in your business, and build a lifestyle that actually supports your growth.

At Gegidze, we make the process straightforward. From company registration and translations to tax filings and residency planning, we help entrepreneurs of all kinds take full advantage of Georgia’s system.

Book a free consultation and see how Georgia’s tax-friendly environment can work for you.

Frequently asked questions (FAQ)

Can foreigners buy apartments in Tbilisi Georgia?

Yes, foreigners can buy property in Georgia without restrictions. Many investors choose apartments for sale in Tbilisi Georgia or apartments in Batumi Georgia because prices are lower than in Western Europe. The process is simple, involves a notary, and often requires an English to Georgian translation of documents.

How much is the property tax in Georgia?

The average property tax in Georgia is much lower than in Europe or the US. Most residential properties are either exempt or taxed at minimal rates, making real estate in Georgia attractive for both locals and foreigners. This is one reason why buying property in Tbilisi Georgia has become popular for long-term investment.

Can I get residency by buying property in Georgia?

Yes, Georgia offers residency by investment. Buying property worth at least $100,000 allows you to apply for temporary residency. Many entrepreneurs combine this with registering a business or opening a Bank of Georgia account to manage income smoothly.

What is the cost of living in Georgia compared to Europe?

The cost of living in Georgia is significantly lower. Renting a modern apartment in Tbilisi might cost €600–800 per month, while the same in Berlin or Paris can exceed €2,000. Utilities, food, and transport are also cheaper. This makes Georgia attractive not just for freelancers and influencers, but also for families and business owners looking for affordable housing and daily expenses.

Is Georgia a good country for tax residency?

Yes, many entrepreneurs apply for Georgian tax residency to optimise personal taxes. Dividends are taxed at just 5%, there’s no wealth tax, and corporate structures like LLCs with Virtual Zone status can pay 0% corporate tax. With English to Georgian translations handled professionally, the setup is straightforward and legal, making Georgia one of the most tax-friendly countries in Europe.